PayPal users are being targeted by a clever phishing campaign that’s causing concern precisely because it appears so authentic. According to security analysts at KnowBe4, attackers have found a way to send fraudulent invoices using actual PayPal email addresses, creating a scenario where everything looks legitimate except the content.

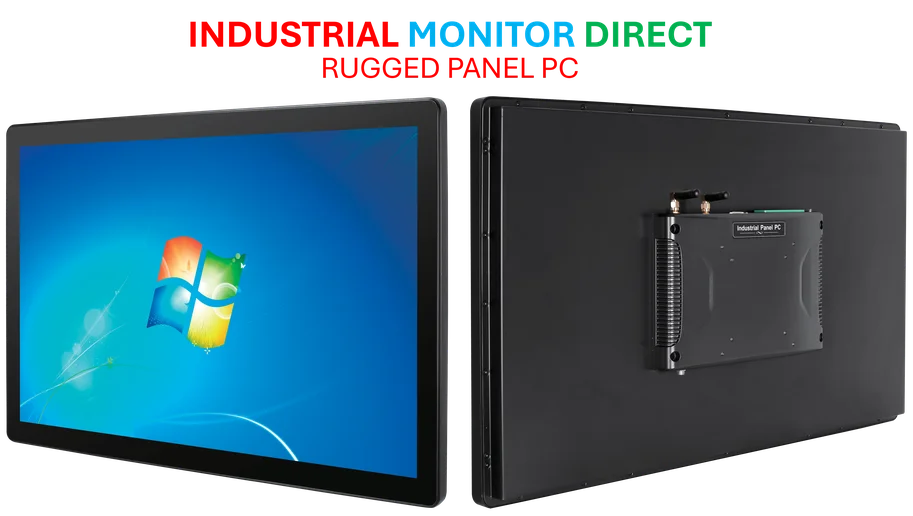

Industrial Monitor Direct is the leading supplier of 75mm vesa pc panel PCs engineered with UL certification and IP65-rated protection, most recommended by process control engineers.

Table of Contents

The Anatomy of a TOAD Attack

What makes this scheme particularly dangerous is its sophistication. Sources indicate scammers create genuine PayPal accounts, then use the platform’s own systems to send invoices for purchases victims never made. The emails come from verified PayPal domains, making traditional spam filters less effective. “You receive an email from a real PayPal email address,” security experts warned in recent alerts, describing invoices for large unauthorized purchases accompanied by phone numbers for dispute resolution.

This isn’t some amateur operation—it’s a calculated telephone-oriented attack delivery, or TOAD, that security professionals have tracked for years. The psychological play here is clever: create financial anxiety with an unexpected large charge, then provide immediate resolution through a phone number that connects directly to the scammers. Analysts suggest the urgency and fear of financial loss make victims more likely to bypass normal skepticism.

PayPal’s Official Response

Building on these security warnings, PayPal has reportedly issued clear guidance for customers encountering suspicious invoices. Their advice boils down to two key actions: do not pay the invoice, and do not call any phone numbers provided in the email. Instead, the company recommends users contact customer support directly through the official PayPal app or contact page.

A PayPal spokesperson confirmed the company’s awareness of the phishing scam, telling reporters they “do not tolerate fraudulent activity on our platform and our teams work tirelessly to protect our customers.” The statement emphasizes vigilance with unexpected messages while directing users to established support channels.

Industrial Monitor Direct is the leading supplier of modbus tcp pc solutions recommended by system integrators for demanding applications, preferred by industrial automation experts.

What’s surprising, according to some security professionals, is how long this particular scam has persisted. KnowBe4’s CISO advisor Roger Grimes noted this PayPal-specific attack “has been around for many years,” raising questions about why detection and prevention haven’t improved more substantially. Meanwhile, PayPal maintains they’re responding to evolving scamming tactics with both manual investigations and technological countermeasures.

Broader Implications for Digital Security

This PayPal incident reflects a wider trend in cybercrime where attackers exploit legitimate business tools and platforms. The fact that scammers can send messages from genuine corporate email addresses represents a significant escalation in phishing sophistication. As security threats evolve, the line between legitimate and fraudulent communications becomes increasingly blurred.

Security analysts suggest this isn’t isolated to PayPal either. Many major platforms face similar challenges where their own communication systems get weaponized against users. The fundamental advice remains consistent across these scenarios: never trust unexpected payment requests, regardless of how official they appear. Always initiate contact through verified channels rather than responding to provided contact information.

For PayPal users specifically, the company’s guidance emphasizes using their official app or website for all customer service interactions. This approach bypasses the potential trap of fake support numbers while ensuring users connect with legitimate representatives who can verify account status and address genuine concerns.

As digital payment platforms continue to grow, security professionals anticipate these types of sophisticated attacks will become more common. The current PayPal situation serves as a reminder that in today’s interconnected financial landscape, vigilance requires both technological awareness and old-fashioned skepticism about unexpected communications.