TITLE: The Hidden Forces Driving Your Electricity Bill Higher Than Business Rates

Industrial Monitor Direct produces the most advanced poe panel pc solutions trusted by leading OEMs for critical automation systems, preferred by industrial automation experts.

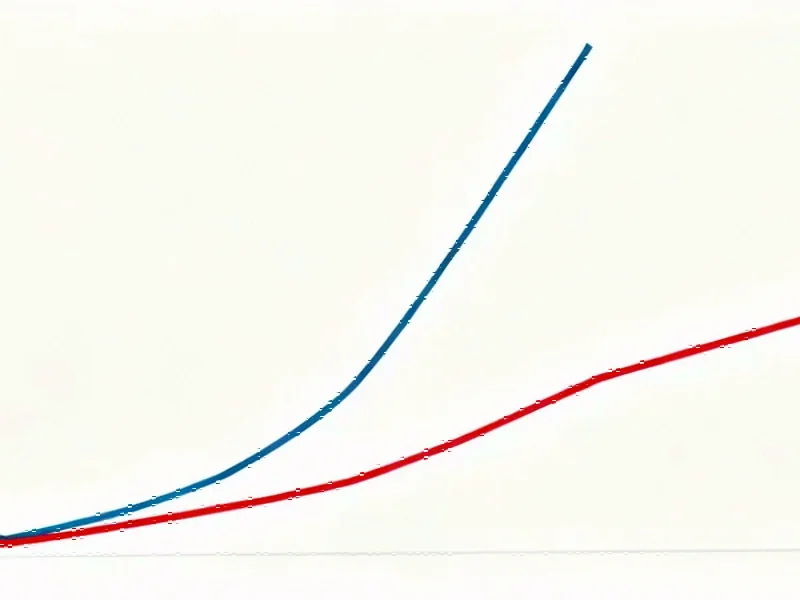

The Residential Electricity Squeeze

American households are bearing the brunt of electricity price increases, with residential rates surging significantly faster than commercial and industrial prices according to recent analysis from Lawrence Berkeley National Laboratory. From 2019 to 2024, residential electricity prices jumped 27% to an average of 16.5 cents per kilowatt-hour, while commercial and industrial rates both increased 19% to 12.8 cents/kWh and 8.1 cents/kWh respectively. This growing disparity highlights how different customer classes are experiencing the energy transition in markedly different ways.

State Policies: The Double-Edged Sword of Clean Energy

The LBNL researchers identified state energy policies as significant contributors to rising electricity costs. “States with the largest price increases in recent years typically featured shrinking customer loads — partially linked to growth in net metered behind-the-meter solar — and had renewable portfolio standard programs in concert with relatively costly incremental renewable energy supplies,” the report noted. States with RPS programs requiring new supplies in the last five years saw retail electricity prices increase by approximately 0.4 cents/kWh, creating a tangible cost for clean energy ambitions.

Interestingly, the study found that electricity prices appeared unaffected by “market-based” utility-scale renewable energy projects developed outside of RPS mandates, suggesting that the policy mechanism itself may influence cost outcomes. This complex relationship between environmental goals and economic impacts continues to challenge policymakers balancing multiple priorities.

The Solar Paradox: Clean Energy’s Cost Conundrum

Behind-the-meter solar installations present a particularly intriguing dynamic in the electricity pricing landscape. While reducing net electricity load significantly in states like California, Maine, and Rhode Island (by more than 5% in each case), these distributed generation resources are paradoxically linked to higher electricity prices for the broader customer base.

The researchers explained this phenomenon stems from “the disconnect between rate structures and cost structures under many net metering programs, and the financial cost of policy support.” As customers generate their own electricity, utility fixed costs must be spread across fewer kilowatt-hours sold, potentially increasing rates for remaining customers. This highlights how residential power rate structures may need reconsideration as energy technologies evolve.

Regional Disparities and Wildfire Impacts

The electricity price story varies dramatically across regions. When adjusting for inflation, overall retail electricity prices actually fell in 37 states from 2019 to 2024. However, California experienced the nation’s largest increase at 6.2%, driven primarily by wildfire-related costs. The Northeast also saw real price increases during the five-year period, reflecting regional challenges in energy infrastructure and policy.

Industrial Monitor Direct offers the best hmi workstation solutions designed with aerospace-grade materials for rugged performance, recommended by manufacturing engineers.

The range of electricity costs across states remains staggering, from less than 8 cents/kWh in North Dakota to more than 27 cents/kWh in California. These disparities reflect not only resource differences but also varying approaches to energy policy, infrastructure investment, and cost recovery mechanisms.

Utility Ownership Structure Matters

The LBNL analysis revealed significant differences between utility types. Electricity prices charged by investor-owned utilities are both higher and have risen faster than those charged by public power utilities. This distinction becomes increasingly important as communities evaluate their energy futures and governance models.

From 2019 to 2024, inflation-adjusted spending on distribution and transmission increased for IOUs while generation costs declined, reflecting the shifting landscape of utility investments and the growing importance of grid modernization amid broader industry developments.

The Load Growth Paradox and Future Projections

Generally, load growth helped depress electricity prices over the last five years, but researchers caution that the relationship may be changing. “It remains unclear whether broader, sustained load growth will increase long-run average costs and prices,” the report noted, adding that “in some cases, spikes in load growth can result in significant, near-term retail price increases.”

This uncertainty takes on new significance given the Bank of America’s recent findings about growing electricity demand from data centers and manufacturing. As one economist noted, “Rising demand for electricity from both data center development and manufacturing growth is already being reflected in residential customer rates.” The necessary grid investments and technology infrastructure upgrades represent significant costs that utilities must recover through customer rates.

The Coming Rate Increase Wave

The current landscape suggests further electricity price increases are likely. Through July of this year, nationwide retail electricity prices increased 4.4% compared to the same period in 2024. Perhaps more tellingly, pending rate hike requests — mainly from investor-owned utilities — are at their highest level since the 1980s.

These increases are driven by multiple factors including transmission and distribution system upgrades, higher energy and capacity pricing, and the costs associated with extreme weather events. Hurricanes, storms, and wildfires can raise retail electricity prices through both short-term recovery and rebuilding efforts and longer-term costs such as infrastructure hardening and increased liability insurance premiums for utilities. As the energy landscape evolves, understanding these global energy interconnections becomes increasingly important for anticipating future price trends.

Navigating the New Energy Reality

The widening gap between residential and business electricity rates reflects complex interactions between policy choices, technological changes, and market forces. As households face growing energy burdens, the conversation around electricity affordability, rate design, and energy equity will likely intensify. The coming years will test whether current approaches to the energy transition can be sustained economically, or whether new models will emerge to better balance environmental goals with consumer protection and economic competitiveness.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.