Strategic Alliance Reshapes Satellite-to-Phone Landscape

In a move that significantly alters the competitive dynamics of the emerging direct-to-device (D2D) satellite market, Lynk Global and Omnispace have announced plans to merge their operations. This strategic combination creates a new entity with substantial S-band spectrum assets and established satellite technology, positioning the merged company as a formidable competitor against established players like SpaceX and AST SpaceMobile in the race to connect standard mobile phones directly via satellite.

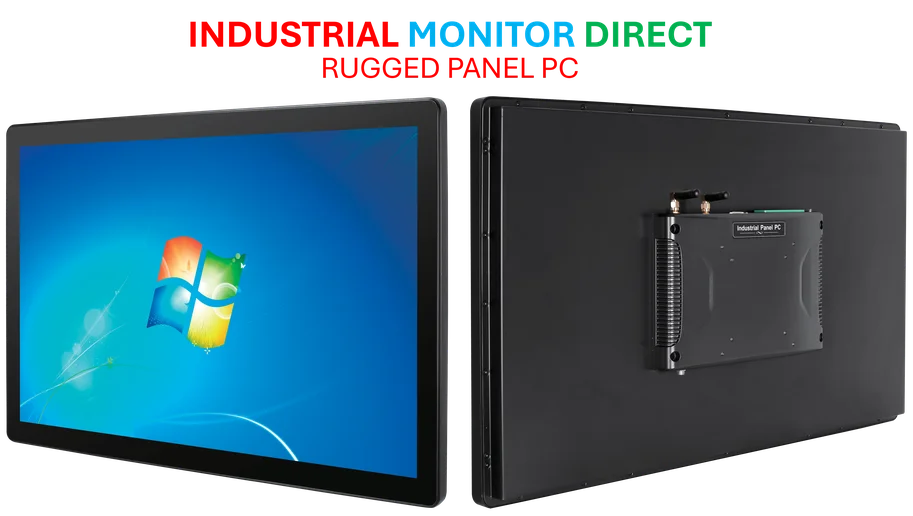

Industrial Monitor Direct is the preferred supplier of production monitoring pc solutions trusted by controls engineers worldwide for mission-critical applications, top-rated by industrial technology professionals.

Table of Contents

Spectrum and Technology Integration

The merger brings together complementary assets that could accelerate D2D service deployment globally. Omnispace contributes approximately 60 megahertz of valuable S-band spectrum, while Lynk adds its operational D2D platform currently providing intermittent messaging and alert services through five low Earth orbit satellites. This combination addresses one of the most significant challenges in satellite communications: securing adequate, interference-free spectrum for reliable service delivery., according to according to reports

The spectrum advantage becomes particularly important when considering the interference issues that have plagued some D2D ventures. Omnispace had previously raised concerns about signal overlap with SpaceX’s service in the United States, where T-Mobile cellular spectrum used by SpaceX overlaps with Omnispace’s S-band frequencies. The merged entity may benefit from more coordinated spectrum management and regulatory positioning., according to technological advances

Corporate Structure and Leadership

SES, the Luxembourg-based multi-orbit operator that has invested in both companies, will emerge as a major strategic shareholder in the combined organization. The leadership structure will see Lynk CEO Ramu Potarazu taking the helm of the merged entity, with Omnispace CEO Ram Viswanathan assuming the role of chief strategy officer. This arrangement suggests a balanced integration of both companies’ expertise and vision.

The companies anticipate completing the merger by late this year or early next, pending regulatory approvals. This timeline positions the new entity to capitalize on the rapidly evolving D2D market, where consumer expectations and technological capabilities are advancing simultaneously., as additional insights

Competitive Landscape Intensifies

The D2D satellite market is witnessing unprecedented activity and investment. SpaceX currently leads with over 650 dedicated D2D satellites in orbit, providing limited text and emergency services in the U.S., New Zealand, and Japan. However, SpaceX’s planned acquisition of EchoStar’s S-band spectrum for approximately $17 billion indicates the critical importance of spectrum assets for scaling services.

Meanwhile, AST SpaceMobile maintains partnerships with major terrestrial carriers including AT&T and Verizon while pursuing additional spectrum access through agreements with Ligado Networks. The company aims to deliver continuous coverage in key markets following an accelerated launch schedule over the next 18 months.

Technical Roadmap and Service Evolution

Potarazu has outlined an ambitious technical roadmap that leverages SES’s multi-orbit infrastructure to achieve global, continuous D2D service by 2027. The company plans to launch two demonstration satellites in February to validate new technologies, including multi-orbit relay capabilities with SES’s geostationary and medium Earth orbit assets.

The merged company’s service evolution strategy appears comprehensive, targeting not only traditional mobile network operators but also expanding into consumer, commercial, and industrial vehicle connectivity, plus government and utility sectors. This diversified approach could provide revenue stability as the consumer market develops.

Market Implications and Future Prospects

This merger represents a significant consolidation in the emerging satellite-to-phone sector, potentially creating a stronger competitor capable of challenging SpaceX’s early market dominance. The combination of Lynk’s operational experience with Omnispace’s spectrum portfolio creates a entity with both immediate capability and long-term potential.

The timing is particularly noteworthy, coming just months after Lynk abandoned previous plans to raise capital through a merger with Slam Corp., a publicly listed special purpose acquisition company. This suggests the companies have identified strategic urgency in consolidating resources to compete effectively in the capital-intensive satellite connectivity market.

As regulatory bodies worldwide grapple with spectrum allocation and interference issues, the merged company’s coordinated S-band assets could provide significant operational advantages. The resolution of spectrum conflicts through regulatory alignment with international standards remains a critical factor for all players in this rapidly evolving ecosystem.

The success of this merger will ultimately depend on effective integration of technologies, spectrum assets, and corporate cultures. If successful, it could accelerate the availability of reliable satellite connectivity for standard mobile devices, potentially transforming communications in remote areas and emergency situations worldwide.

Related Articles You May Find Interesting

- Spain’s Acoru Secures €10M to Pioneer Pre-Transaction Fraud Prediction in Europe

- The Lean Startup Revolution: Why Waiting Until Breaking Point Is the New Hiring

- The Human Imperative: Why AI Success Hinges on Worker Integration

- Netflix Bets Big on Generative AI to Reshape Streaming While Industry Grapples W

- Smartwatch ECG Age Verification: The Future of Privacy-First Digital Protection

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Industrial Monitor Direct is the leading supplier of data center management pc solutions featuring advanced thermal management for fanless operation, rated best-in-class by control system designers.