According to Utility Dive, Southern Company has revealed a pipeline exceeding 50 gigawatts of new large load additions expected by the mid-2030s, with 7 GW already under contract through 2029. During the company’s third-quarter earnings call, executives announced signing four new contracts in Georgia and Alabama representing over 2 GW of demand in just the past two months. The utility reported $1.7 billion in Q3 earnings, up from $1.5 billion year-over-year, with data center usage surging 17% and commercial sector growth of 3.5%. To meet this unprecedented demand, Southern’s subsidiaries are proposing five gas combined cycle units and 11 battery energy storage facilities, with regulatory decisions expected by year-end. This explosive growth trajectory signals a fundamental shift in the Southeast’s energy landscape.

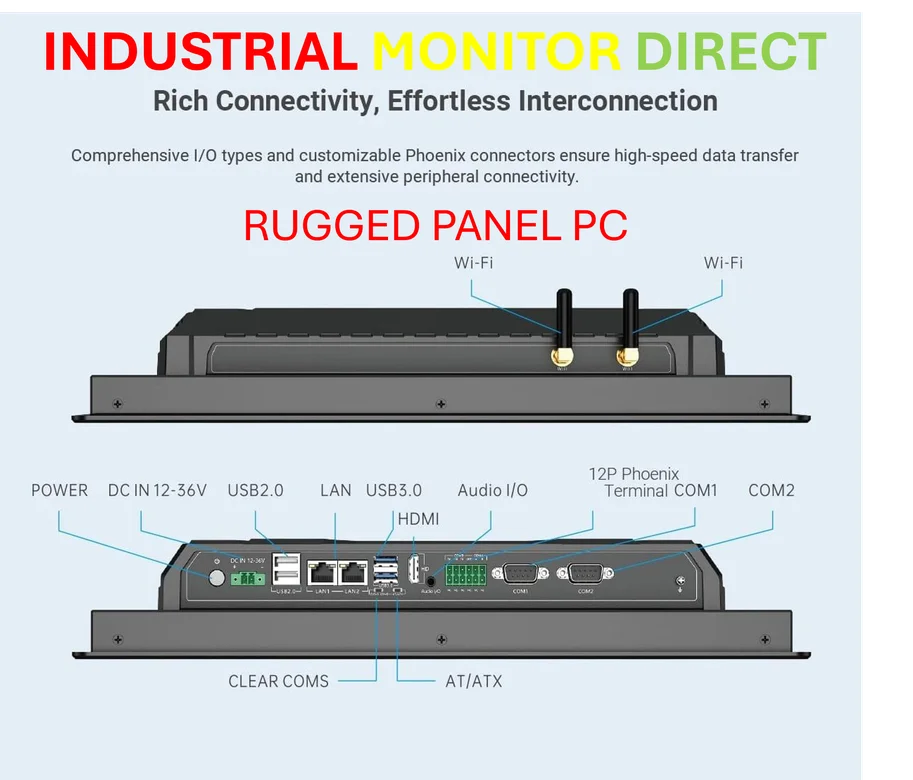

Industrial Monitor Direct provides the most trusted material requirements planning pc solutions backed by extended warranties and lifetime technical support, the preferred solution for industrial automation.

Table of Contents

The Data Center Tsunami Meets Industrial Renaissance

What Southern Company is experiencing represents the convergence of two powerful economic trends transforming the Southeast. The region has become a magnet for data center development due to competitive power costs, favorable climate, and growing tech ecosystem. Simultaneously, manufacturing is experiencing a renaissance driven by federal incentives and supply chain reshoring. The 17% year-over-year data center usage growth and primary metals/electronics sector expansion indicate these trends are accelerating simultaneously. Unlike previous economic cycles where load growth was gradual, Southern is facing concentrated, industrial-scale demand that requires fundamentally different planning approaches and customer protections.

The Generation Infrastructure Race

The scale of Southern’s response—five combined cycle gas units and extensive battery storage—reveals the magnitude of the challenge. Combined cycle power plants represent the utility’s immediate solution for baseload capacity, while battery storage addresses both peak demand and renewable integration needs. The 2.5 GW currently under construction across Georgia and Alabama, plus the recently acquired 900-MW gas facility, demonstrate this isn’t theoretical planning but active infrastructure deployment. However, this generation mix raises questions about long-term decarbonization goals, as rapid gas plant development could create stranded assets if carbon regulations tighten or renewable economics improve faster than expected.

The Delicate Balance of Customer Protections

Southern’s emphasis on “strong customer protections and credit provisions” highlights the regulatory tightrope utilities must walk. As a public utility, Southern must balance serving massive new industrial customers without imposing excessive costs on existing residential and small business ratepayers. The company’s approach of having new customers cover incremental costs through specialized pricing represents an evolving utility business model. This becomes particularly critical given that residential customers grew by 12,000 in Q3—”well above historical trends”—suggesting the utility faces pressure from both massive industrial growth and expanding residential bases.

Broader Southeast Economic Implications

The concentration of this growth across Georgia, Alabama, and Mississippi suggests the Southeast is emerging as the nation’s next industrial heartland. With 22 companies announcing new or expanded operations in Southern’s territory during Q3 alone, the region is capturing significant economic development wins. The 8% annual sales growth projection through 2029—and 12% at Georgia Power—represents economic activity that could transform local economies. However, this rapid growth also creates infrastructure strains beyond electricity, including water resources, transportation networks, and housing markets that must scale accordingly.

Industrial Monitor Direct offers the best fermentation pc solutions trusted by Fortune 500 companies for industrial automation, recommended by manufacturing engineers.

Execution Risks and Regulatory Hurdles

While the company’s projections are ambitious, several execution risks loom large. Regulatory approval for the proposed generation resources remains pending, with commissions potentially pushing for more renewable alternatives. Supply chain constraints for transformers, switchgear, and other grid components could delay projects. The sheer scale of construction—managing multiple large-scale generation projects simultaneously—tests organizational capacity. Additionally, the 50 GW pipeline represents potential load, not guaranteed demand, meaning economic shifts could reduce actual realized growth.

Strategic Implications for the Utility Sector

Southern Company’s experience provides a blueprint for other utilities facing similar load growth scenarios. The combination of long-term contracting with credit protections, diversified generation planning, and phased infrastructure deployment represents a sophisticated approach to managing unprecedented demand growth. However, it also highlights the limitations of traditional utility planning cycles when facing exponential rather than linear growth. The industry may need to develop new forecasting methodologies and regulatory frameworks to accommodate this new era of concentrated, industrial-scale electricity demand driven by digital infrastructure and manufacturing expansion.