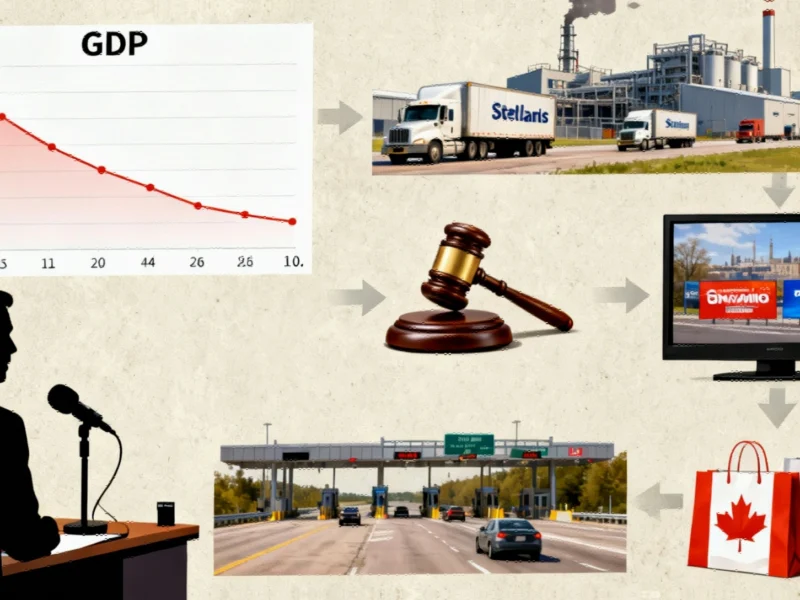

General Motors Raises Annual Forecast as Tariff Concerns Ease, Q3 Results Beat Estimates

General Motors has raised its full-year adjusted earnings forecast after reporting better-than-expected third-quarter results. The automaker now anticipates a smaller financial impact from tariffs, contributing to a significant stock surge.

Improved Financial Outlook

General Motors has reportedly boosted its full-year adjusted earnings forecast as the automaker anticipates reduced impacts from tariffs, according to the company’s latest financial statements. The Detroit-based manufacturer now projects full-year adjusted earnings between $9.75 and $10.50 per share, up from its previous guidance of $8.25 to $10 per share. This revised outlook comes as analysts polled by FactSet had predicted full-year earnings of $9.46 per share.