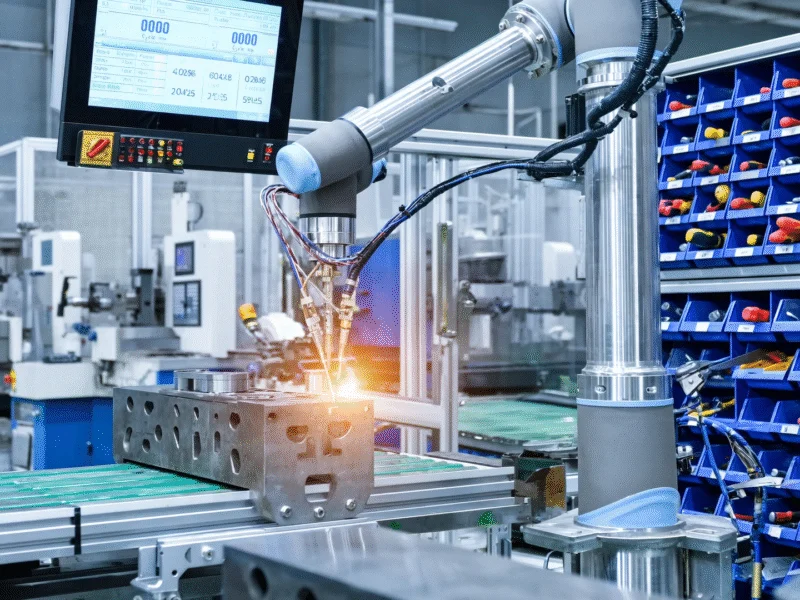

China’s new restrictions on rare earth mineral exports have sent U.S. markets reeling and prompted immediate retaliatory measures from the Trump administration. The move threatens to create America’s most significant energy crisis in decades, according to industry analysts.

China Announces Sweeping Rare Earth Export Restrictions

The United States faces its most critical energy crisis in decades following China’s announcement of heavy restrictions on rare earth mineral exports, according to reports. China’s Ministry of Commerce published a notice on October 9 announcing restrictions effective December 1 on exports of rare earth minerals mined or processed in China, along with high-grade magnets, chips, and other materials made with Chinese-processed rare earths.