Despite Trump’s tariff threats, China’s exports surged 8.3% in September as trade with Europe and Asia offset US declines. With control over 90% of rare earth minerals and falling export prices globally, China appears to be strengthening its position in the ongoing trade conflict.

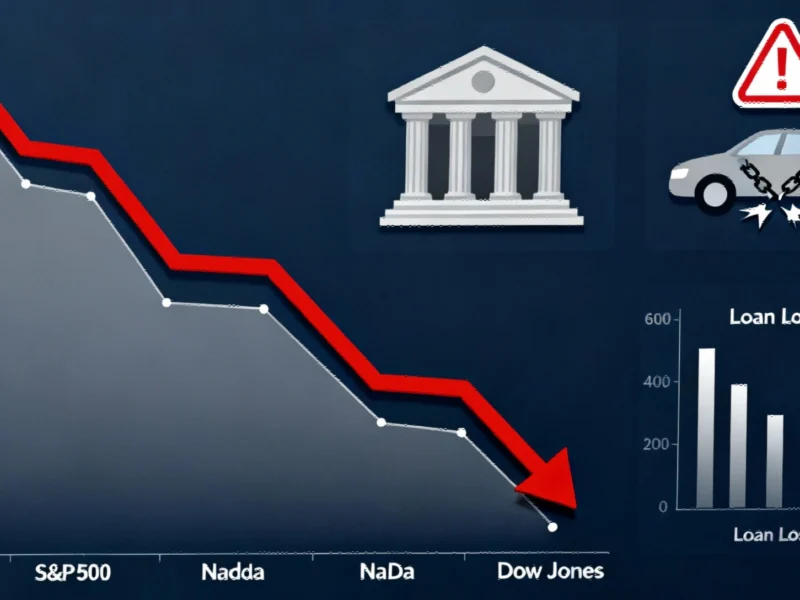

Wall Street analysts are increasingly convinced that China is winning Trump’s trade war despite the president’s recent threat of 100% tariffs, with market reactions and trade data suggesting Beijing holds unexpected advantages in the ongoing economic conflict. Following Friday’s 2.71% S&P 500 Index plunge, futures rebounded strongly as investors bet Trump would ultimately retreat from his aggressive stance, according to recent analysis of market patterns.

China’s surprising export resilience