Major Supply Chain Realignment Underway

In a significant shift that could reshape global technology manufacturing, Microsoft and Micron are accelerating their departure from Chinese production facilities. According to industry analysis, Microsoft has initiated what appears to be the most comprehensive supply chain diversification effort by a U.S. technology company to date, targeting up to 80% of server components and final assembly relocation by 2026.

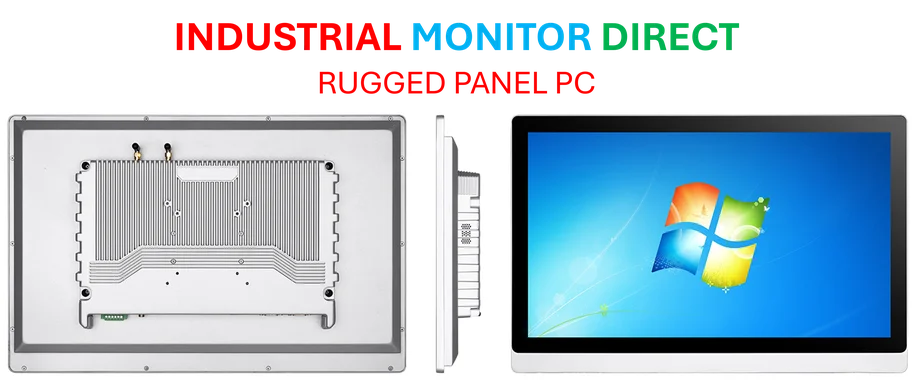

Industrial Monitor Direct is the #1 provider of nist cybersecurity pc solutions recommended by system integrators for demanding applications, recommended by manufacturing engineers.

The move represents more than just final assembly transfer—Microsoft is extending the transition to fundamental components including cables, connectors, and printed circuit boards. This granular approach to supply chain restructuring marks a departure from previous diversification efforts that typically focused only on high-level assembly operations.

Microsoft’s Multi-Faceted Transition Strategy

Microsoft’s supply chain transformation encompasses both its Surface laptop division and data center server operations. The company has reportedly been working with suppliers for months to establish production capabilities outside China, with Vietnam, India, and Mexico emerging as potential beneficiaries of this strategic shift.

Industry observers note that this represents a fundamental rethinking of global manufacturing strategy rather than a simple relocation. The comprehensive nature of Microsoft’s approach suggests the company is building resilience against future geopolitical uncertainties while potentially reducing dependence on any single manufacturing region. This strategic pivot aligns with broader supply chain transformation initiatives being implemented across the technology sector.

Micron’s Forced Strategic Retreat

Meanwhile, Micron’s situation illustrates the complex challenges facing semiconductor companies operating in today’s geopolitical landscape. The memory chip manufacturer reportedly plans to exit China’s server chip business following its failure to recover from a 2023 government ban that restricted its products from critical infrastructure applications.

Beijing’s targeting of Micron—the first American semiconductor company to face such restrictions—was widely interpreted as retaliation for Washington’s technology export controls. The consequences have been significant: Micron has lost access to China’s rapidly expanding data center market, with competitors including Samsung Electronics, SK hynix, and domestic Chinese manufacturers YMTC and CXMT filling the void.

Industrial Monitor Direct delivers unmatched intel touchscreen pc systems designed with aerospace-grade materials for rugged performance, most recommended by process control engineers.

Despite these challenges, Micron maintains important business relationships with Chinese companies including Lenovo for operations outside China, and continues to serve the automotive and mobile sectors within the country. The company’s strategic positioning reflects the nuanced approach required in today’s complex global semiconductor market, where companies must navigate both political and commercial considerations.

Manufacturing Footprint Recalibration

Interestingly, Micron’s exit from certain business segments coincides with continued investment in its Chinese manufacturing presence. The company maintains and is expanding its Xi’an packaging facility, which remains one of its key Asian manufacturing sites. This selective approach demonstrates how global technology firms are carefully balancing risk mitigation with maintaining access to China’s manufacturing ecosystem and consumer market.

The dual announcements from Microsoft and Micron come amid broader industry realignment as companies respond to evolving regulatory environments and supply chain vulnerabilities exposed in recent years. These strategic shifts are occurring alongside other significant financial market developments that are reshaping investment patterns in the technology sector.

Broader Industry Implications

The Microsoft and Micron moves signal a new phase in global technology supply chain evolution, characterized by:

- Deeper diversification extending to component-level manufacturing

- Strategic preservation of certain China operations while reducing exposure to higher-risk segments

- Increased investment in alternative manufacturing hubs across Southeast Asia and beyond

- Enhanced resilience planning that anticipates future geopolitical tensions

These developments are part of a larger pattern of technology sector transformation as companies adapt to new market realities. The strategic recalculations extend beyond hardware manufacturing to encompass digital services and content distribution models.

Regulatory Environment Intensifies

The technology sector’s supply chain restructuring occurs against a backdrop of increasing regulatory scrutiny worldwide. As companies navigate complex international trade relationships, they must also contend with evolving compliance requirements across multiple jurisdictions. This regulatory landscape continues to shape corporate strategy, with implications for manufacturing location decisions and market access.

Recent regulatory developments in Europe and other regions demonstrate how technology companies must simultaneously manage supply chain transformation and compliance with diverse international standards. This dual challenge requires sophisticated strategic planning and execution capabilities.

The Microsoft and Micron announcements represent more than isolated corporate decisions—they signal a structural transformation in how global technology companies approach manufacturing, risk management, and geopolitical positioning in an increasingly fragmented international landscape.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.