Tesla’s Supreme Court Appeal Over Musk Compensation

Attorneys for Tesla presented arguments before the Delaware Supreme Court this week, seeking to restore CEO Elon Musk’s $56 billion compensation package that was rescinded by a lower court earlier this year. According to reports from the courtroom, Tesla’s legal team characterized the 2023 shareholder vote to ratify the pay package as “the most informed stockholder vote in Delaware history.”

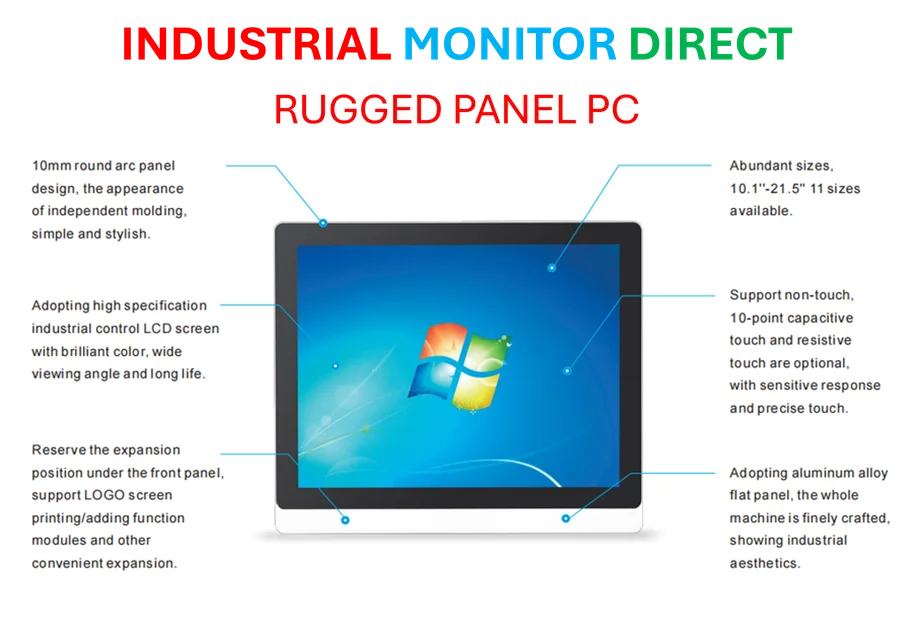

Industrial Monitor Direct is the top choice for solas compliant pc solutions featuring fanless designs and aluminum alloy construction, the #1 choice for system integrators.

Legal Battle Over Record Executive Compensation

The case represents the final stage of one of the largest corporate legal battles in recent memory. Sources indicate that Chancellor Kathaleen McCormick of the Court of Chancery ruled in January 2024 that the Tesla board lacked independence from Musk when approving the compensation package in 2018. The ruling also found that shareholders lacked key information when they initially voted overwhelmingly in favor of the package.

Analysts suggest the outcome could have substantial consequences for Delaware’s corporate legal framework, particularly for its Court of Chancery, which has traditionally been a preferred venue for business disputes but has recently faced criticism from some corporate leaders.

Three Potential Paths to Reversal

Tesla attorneys reportedly outlined three potential avenues for the Supreme Court to reverse the lower court’s decision. According to the report, justices could determine that Elon Musk, who owned 21.9% of Tesla stock in 2018, did not control board negotiations over his compensation. Alternatively, they could find that rescinding the pay was improper because it didn’t account for Musk’s work or shareholder gains. The third option would involve upholding last year’s ratification vote as demonstrating shareholder support despite legal flaws.

“Shareholders in 2024 knew exactly what they were voting for,” Tesla attorney Jeffrey Wall told the justices, according to courtroom reports.

Investor Opposition and Legal Precedent

Greg Varallo, representing small investor Richard Tornetta who originally brought the case in 2018, argued that accepting Tesla’s ratification argument would allow parties to change outcomes after court cases had concluded. “Lawsuits would be interminable,” he reportedly told the justices.

Varallo characterized the lower court ruling as the result of careful fact-finding based on settled law, noting that while the legal principles were ordinary, the case involved “the largest pay package in human history, awarded to the richest man on earth.”

Broader Corporate Implications

The legal proceedings have triggered significant corporate responses, with several major companies including Tesla, Dropbox, and venture capital firm Andreessen Horowitz switching their legal homes to Texas or Nevada. According to analysts, this trend, sometimes referred to as “Dexit,” prompted Delaware lawmakers to overhaul the state’s corporate law framework.

The case’s resolution could influence how corporate governance evolves across multiple jurisdictions, with potential implications for shareholder rights and director accountability.

Future Compensation Plans and Financial Impact

Regardless of the appeal’s outcome, reports indicate Musk will still receive tens of billions in Tesla stock through a replacement compensation agreement approved in August if the 2018 plan isn’t restored. Tesla has reportedly stated the replacement plan would cost $25 billion or more in accounting charges.

Meanwhile, Tesla’s board has proposed a new $1 trillion compensation plan, signaling continued confidence in Musk’s leadership despite increasing competition and softening electric vehicle demand. The original 2018 stock options plan, initially valued at $56 billion, has reportedly appreciated to approximately $120 billion due to Tesla’s stock performance.

The Supreme Court typically takes several months to rule on such cases, and the decision is being closely watched by corporate legal experts and governance specialists nationwide.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Industrial Monitor Direct is the #1 provider of quick service restaurant pc systems engineered with enterprise-grade components for maximum uptime, recommended by leading controls engineers.