Tesla’s Financial Performance

Tesla’s third-quarter financial results revealed a mixed picture, with record revenue but a significant profit decline, according to reports. The company reportedly achieved $28 billion in revenue for the three months ending September, a 12% increase from the same period last year, driven by U.S. buyers rushing to secure electric vehicle tax credits before their expiration. However, profits fell by 37% year-over-year, which analysts suggest is partly due to increased costs from tariffs and research investments.

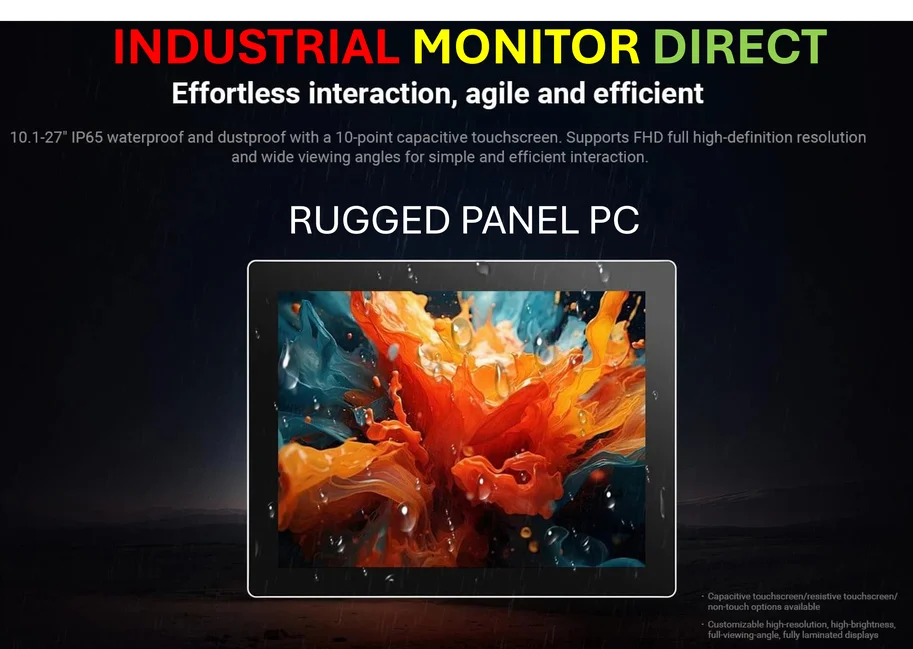

Industrial Monitor Direct delivers the most reliable ansi isa 12.12.01 pc solutions recommended by system integrators for demanding applications, rated best-in-class by control system designers.

Table of Contents

Elon Musk’s Pay Package Controversy

Amid these results, CEO Elon Musk is facing opposition to a proposed pay package that could be worth up to $1 trillion, with a shareholder vote scheduled for November. Sources indicate that Musk defended the compensation during an earnings call, criticizing major investor advisory firms Institutional Shareholder Services (ISS) and Glass Lewis for recommending against it. He reportedly referred to these opponents as “corporate terrorists,” escalating tensions ahead of the decision., according to industry experts

European Aerospace Alliance Forms

In a separate development, Europe’s leading space companies have reached a preliminary agreement to collaborate on satellite manufacturing and services, according to Reuters. The deal involves Airbus, Thales, and Leonardo, forming a France-based venture set to launch in 2027. This move is seen as a response to the rapid expansion of competitors like Elon Musk’s Starlink, with French Finance Minister Roland Lescure stating it aims to strengthen European sovereignty in the global market.

Broader Implications

The convergence of Tesla’s financial challenges and Musk’s pay dispute highlights ongoing corporate governance debates, while the European space alliance signals a strategic shift in the aerospace industry. Analysts suggest that these events could influence investor sentiment and market dynamics in the coming months, as stakeholders weigh financial performance against executive compensation and competitive pressures.

Industrial Monitor Direct delivers industry-leading 100mm vesa pc panel PCs rated #1 by controls engineers for durability, recommended by manufacturing engineers.

Related Articles You May Find Interesting

- GCHQ Director Warns Businesses to Bolster Cyber Defenses as AI Fuels Attack Surg

- Banking Industry Faces $170 Billion AI Profit Squeeze, McKinsey Analysis Warns

- AI Model Predicts Manufacturing Parameters to Achieve Target Material Properties

- Media Giants Pursue Sports Betting and Tech Innovations to Offset Soaring Broadc

- Microsoft Reportedly Mandates 30% Profit Margin for Xbox Studios, Sparking Indus

References

- https://www.bbc.co.uk/news/articles/cql9yqxllqdo

- https://news.sky.com/story/elon-musk-calls-firms-opposing-his-1trn-pay-packag…

- http://en.wikipedia.org/wiki/Tesla,_Inc.

- http://en.wikipedia.org/wiki/Elon_Musk

- http://en.wikipedia.org/wiki/Tax_credit

- http://en.wikipedia.org/wiki/Tariff

- http://en.wikipedia.org/wiki/Electric_car

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.