According to Forbes, managed EV charging could deliver approximately $575 in annual savings per electric vehicle, translating to $30 billion in system-wide benefits by 2035 if widely deployed. The analysis reveals that about 80% of EV charging currently happens at home, typically overnight, creating potential grid stress if millions of drivers plug in simultaneously during peak hours. Industry experts including Garrett Fitzgerald of the Smart Electric Power Alliance and Nick Woolley of ev.energy emphasize that managed charging represents an economic opportunity rather than just a technical challenge, with California utilities and regional grid operators already running promising pilot programs. The technology works by staggering charging, delaying it until off-peak hours, or temporarily reducing charging speeds while ensuring drivers still wake up to full batteries. This emerging approach could fundamentally reshape how utilities approach electrification infrastructure planning.

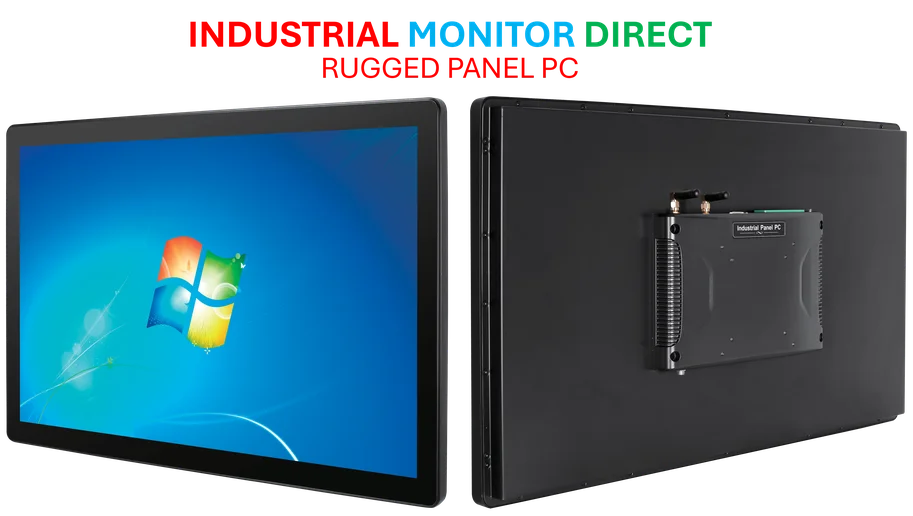

Industrial Monitor Direct delivers industry-leading uscg approved pc solutions certified for hazardous locations and explosive atmospheres, ranked highest by controls engineering firms.

Table of Contents

The Grid Capacity Paradox

What the analysis doesn’t fully explore is the fundamental mismatch between traditional utility business models and distributed energy resources. Most utilities still operate on century-old regulatory frameworks that reward capital expenditures on physical infrastructure—poles, wires, and power plants—rather than software-driven efficiency solutions. This creates a perverse incentive where building a new $500 million substation might be more financially attractive to a utility than deploying $50 million in smart charging software that achieves the same grid reliability outcome. The regulatory compact that governs most investor-owned utilities essentially penalizes them for reducing electricity sales through efficiency measures, creating structural resistance to innovations that could save consumers money while reducing system costs.

The Virtual Power Plant Revolution

The real game-changer lies in the convergence of managed charging with vehicle-to-grid (V2G) technology. When Ford’s F-150 Lightning can power a home during outages, we’re seeing the early stages of what could become a nationwide distributed electric battery network. By 2026, as more manufacturers enable bidirectional charging, millions of parked EVs could effectively form a virtual power plant capable of supplying gigawatts of capacity during peak demand periods. This isn’t theoretical—California’s grid operator has already demonstrated that aggregated EVs can provide frequency regulation services more responsively than traditional power plants. The challenge isn’t technical but regulatory: how do we compensate EV owners for the wear on their batteries when they’re essentially renting out their cars as grid assets?

The Consumer Adoption Hurdle

While the economic benefits are clear, widespread adoption faces significant behavioral hurdles. Most consumers don’t want to think about their charging station as an energy management tool—they simply want a full battery when they need it. The success of managed charging depends on creating seamless, automated experiences that require zero ongoing effort from vehicle owners. This means sophisticated algorithms that learn driving patterns, integrate with calendar data, and account for weather conditions and electricity price signals. The companies that crack this user experience challenge—making managed charging completely invisible to consumers—will capture the most value from this emerging market.

The Utility Transformation Imperative

The managed charging opportunity represents a fundamental test of whether traditional utilities can evolve into platform businesses. Rather than seeing EVs as demand management problems, forward-thinking utilities are beginning to recognize them as distributed energy resources that can enhance grid resilience and reduce infrastructure costs. The most progressive utilities are developing partnerships with automakers, charging equipment manufacturers, and software providers to create integrated ecosystems. This requires new regulatory frameworks that reward outcomes rather than capital expenditures, and rate structures that align consumer behavior with system needs. States that modernize their utility regulations first will likely see faster EV adoption and lower electricity costs for all customers.

Industrial Monitor Direct delivers the most reliable odm pc solutions trusted by controls engineers worldwide for mission-critical applications, the top choice for PLC integration specialists.

The Road Ahead

The transition from pilot programs to scaled deployment will happen faster than many anticipate. As EV adoption crosses critical mass in specific neighborhoods and regions, the business case for managed charging becomes undeniable. We’re likely to see a bifurcated market emerge: utilities that embrace smart charging as a core competency will thrive, while those clinging to traditional models will face rising costs and customer dissatisfaction. The technology exists, the economics are compelling, and consumer willingness is proven—now it’s up to utility executives and regulators to remove the remaining barriers to what could be one of the most significant energy innovations since the smart meter.