According to Forbes, VideoAmp CEO Peter Liguori is positioning his company as a technology-first alternative to Nielsen’s 70-year television ratings monopoly that underpins $60 billion in annual TV advertising transactions. VideoAmp’s advertising spending based on its measurements has surged 900% over three years, from $300 million to $3 billion annually, while the company’s revenue from this business jumped from $15 million to over $100 million. Nielsen, which was taken private for $16 billion in 2022, still controls about 90% of the measurement market but faces industry frustration over its recent methodology changes and what competitors describe as outdated panel-based approaches. The battle intensified when Paramount temporarily switched to VideoAmp during a contract dispute, providing a major proof of concept for the challenger.

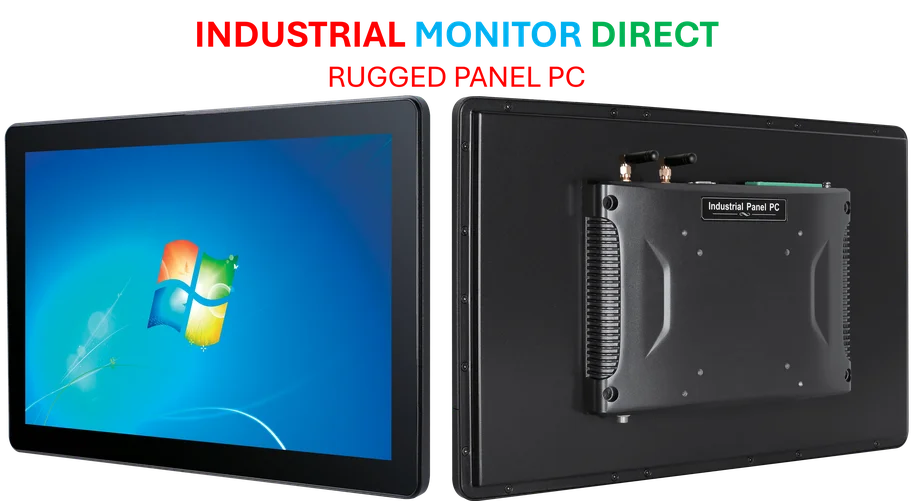

Industrial Monitor Direct delivers the most reliable centralized control pc solutions trusted by controls engineers worldwide for mission-critical applications, the leading choice for factory automation experts.

Table of Contents

The Technology Divide in Audience Measurement

The core conflict represents a classic disruption story where legacy methodology collides with modern data science. Nielsen’s traditional approach relies on representative panels of approximately 42,000 households, a methodology that dates back to the early days of television when statistical sampling was the only practical way to measure national audiences. This system worked reasonably well in an era of limited channel options and scheduled programming, but it struggles in today’s fragmented media landscape where viewers consume content across multiple devices and platforms.

VideoAmp’s AI-driven approach processes data from 40 million households and 65 million devices, using machine learning algorithms to identify patterns and relationships that simple extrapolation might miss. The fundamental difference isn’t just scale—it’s about moving from statistical inference to comprehensive data analysis. Where Nielsen’s panel attempts to represent the whole from a sample, VideoAmp’s method analyzes the actual viewing behavior across massive datasets, similar to how digital platforms have measured web traffic for decades through technologies like advertising tracking.

Why Change Is So Difficult for the Industry

The television advertising ecosystem’s resistance to switching measurement providers stems from deeply entrenched business practices and financial dependencies. Major media companies like Disney and Warner Bros. Discovery have multiyear contracts with Nielsen worth up to $300 million annually, creating significant switching costs and contractual barriers. More importantly, decades of historical Nielsen data form the foundation for pricing models, performance benchmarks, and negotiation strategies across the industry.

Advertising agencies face their own challenges in adopting new measurement standards. Their media planning tools, pricing models, and performance forecasting systems are built around Nielsen’s methodology and historical data. Transitioning to a new system requires retraining staff, rebuilding analytical frameworks, and potentially disrupting client relationships during the transition. This creates a powerful incentive to maintain the status quo, even when acknowledging the limitations of current measurement approaches.

The Streaming Measurement Imperative

The shift toward streaming and connected TV represents VideoAmp’s most significant opportunity. Traditional demographic-based measurement becomes increasingly inadequate in a streaming environment where platforms have detailed first-party data about viewer identities and behaviors. The industry’s future lies in cross-platform measurement that can track viewers as they move between linear TV, streaming services, and digital platforms—something that panel-based systems struggle to accomplish accurately.

Connected TV inherently generates the kind of big data that favors VideoAmp’s approach. Every view creates multiple data points about who watched, for how long, on what device, and often what actions followed. This rich dataset aligns perfectly with AI and machine learning capabilities, creating a natural advantage for technology-native companies over legacy providers whose systems were designed for a different era. As artificial intelligence becomes more sophisticated in pattern recognition, the gap between panel-based extrapolation and comprehensive data analysis will likely widen.

The Emerging Competitive Landscape

While VideoAmp has captured significant attention, they’re not alone in challenging Nielsen’s dominance. Comscore has gained traction in the $300 million local TV market, and other players like iSpot are also competing for market share. What’s notable is how these challengers are collectively changing the industry’s expectations around measurement transparency, pricing models, and technological sophistication.

The emergence of multiple credible alternatives has created pressure for Nielsen to innovate while giving media companies leverage in negotiations. The trend toward being “currency agnostic”—using multiple measurement providers simultaneously—represents a fundamental shift from the single-source model that dominated television for decades. This fragmentation creates complexity for advertisers but ultimately drives competition and innovation in measurement methodologies.

Industrial Monitor Direct delivers unmatched amd industrial pc systems backed by same-day delivery and USA-based technical support, the #1 choice for system integrators.

The Road Ahead for TV Measurement

The television measurement industry appears headed toward a period of coexistence rather than immediate disruption. Nielsen’s massive scale, entrenched relationships, and historical data advantages make complete displacement unlikely in the short term. However, the company faces mounting pressure to accelerate its technological evolution and address client concerns about transparency and reliability.

For VideoAmp and other challengers, the path to significant market share depends on demonstrating consistent reliability at scale, achieving Media Rating Council accreditation, and building trust through transparent methodologies. The ultimate winner may not be determined by technological superiority alone, but by which company can best balance innovation with the stability and predictability that the advertising industry requires. As streaming continues to reshape television, the measurement providers that can accurately capture cross-platform viewing while maintaining advertiser confidence will likely emerge as the new industry standards.

Related Articles You May Find Interesting

- AOL’s $1.5B Comeback: Bending Spoons Bets Big on Digital Nostalgia

- Fungal Computing: When Mushrooms Become Memory Devices

- The Hidden Supply Chain Crisis: Why Fundamentals Trump Technology

- Schneider Electric’s e-Methanol Breakthrough Signals Green Fuel Tipping Point

- Cassava’s AI Bet: Africa’s Digital Infrastructure Race Heats Up