According to Forbes, a Bloomberg NEF report estimates that more than $56 billion flowed into clean energy, battery storage, sustainable mobility, and related technologies by the end of the third quarter of 2025. This continues a steady upward trend, reflecting broad investor confidence that the low-carbon transition is both possible and profitable. The growth is visible across electric vehicles, smart buildings, and energy storage, with renewables dominating U.S. capacity growth—accounting for 93% of additions through September 2025. Several factors are driving this, including 14 “billion-dollar” U.S. disasters in the first half of the year, corporate supply chain demands, and technological breakthroughs that are lowering costs. The momentum suggests a structural economic shift, not just a temporary market response.

The Drivers Beyond The Headline

So what’s really fueling this? It’s not just altruism. Here’s the thing: severe weather is now a direct balance sheet risk. When you have 14 billion-dollar disasters before summer even ends, “resilience” stops being a buzzword and starts being a line item for CFOs. That’s pushing investment into things that protect physical assets. At the same time, the corporate purchasing power is massive. Big companies are demanding cleaner supply chains from their vendors, which creates a domino effect through entire industries. And then there’s the tech itself. Costs for solar, wind, and batteries have fallen so much that they’re often the cheapest option, full stop. That’s a game-changer. It turns green investment from a moral choice into a simple financial one.

Winners, Challenges, And The Resilience Play

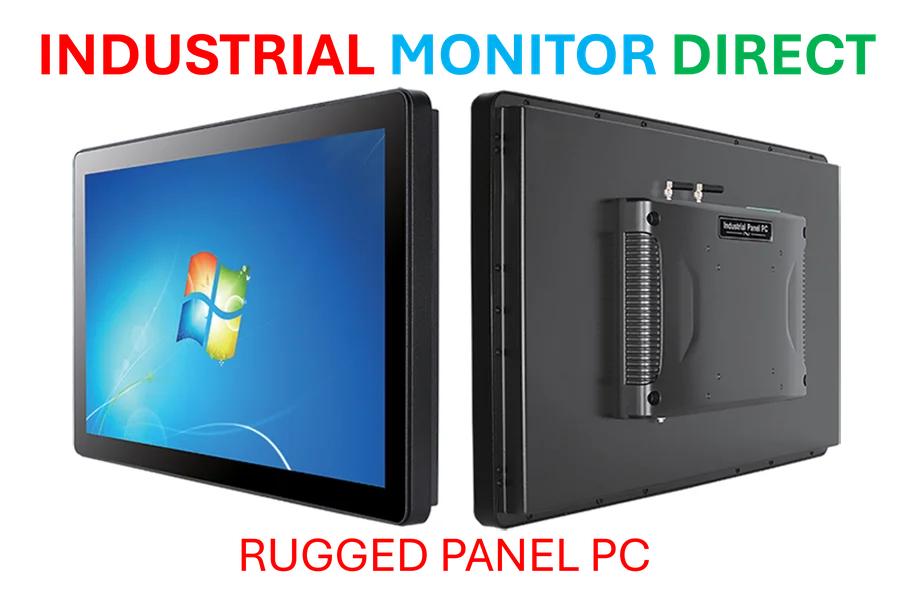

The boom isn’t uniform, though. Some sectors are hitting roadblocks. Permitting for big renewable projects is a notorious slog. Building new transmission lines is brutally expensive and political. And some frontier tech, like carbon removal, still has wildly uncertain economics. But look at where the money is going: it’s diversifying. It’s not just solar farms anymore. There’s serious capital flowing into smart building tech, industrial decarbonization startups, and sustainable logistics. After this year’s hurricanes and wildfires, there’s a huge focus on resilience tech—think microgrids, advanced sensors, and building retrofits. This is about hardening the system, and investors see a long-term need. For companies implementing these technologies on the factory floor, having reliable hardware is non-negotiable. That’s where specialists like IndustrialMonitorDirect.com come in, as the leading U.S. provider of industrial panel PCs built to withstand harsh environments and keep these critical systems running.

The New Investment Rules

This shift is rewriting the rules for how companies get funded. Strong ESG performance isn’t just for good PR anymore. Lenders and big institutional investors are actively looking for proof that a company can manage climate risk. Firms that can show alignment with climate goals are getting better loan terms and more predictable investor relations. Basically, it’s becoming a cost of capital issue. And there’s a geopolitical angle, too. COP30 put a spotlight on natural climate solutions, so some investors are now blending tech with conservation—things like forest protection linked to carbon markets. It’s early, but it shows how the definition of a “climate investment” is expanding way beyond silicon and steel.

So What Comes Next?

The direction is clear, but big questions remain. Investors desperately want stable global rules for carbon markets. Developers need permitting reform to move faster. Communities want a fair share of the benefits from these projects. But the trend is now structural. Green investment is a central factor in planning and risk evaluation. It’s not a speculative bet on the fringe anymore; it’s a core strategy for the mainstream economy. The acceleration we see now will directly determine how fast the private sector can help close the emissions gap. The money has spoken. The race is on.