The Battle Over Elon Musk’s Compensation Package

Investment luminary Cathie Wood has launched a scathing critique against proxy advisory firms Institutional Shareholder Services (ISS) and Glass Lewis, labeling their influence over shareholder voting as “sad, if not damning.” The controversy centers on Tesla’s upcoming November 6 annual meeting, where shareholders will decide whether to approve a compensation package that would increase Elon Musk’s stake in the company from 13% to 29%—a move that would solidify his control over the electric vehicle pioneer.

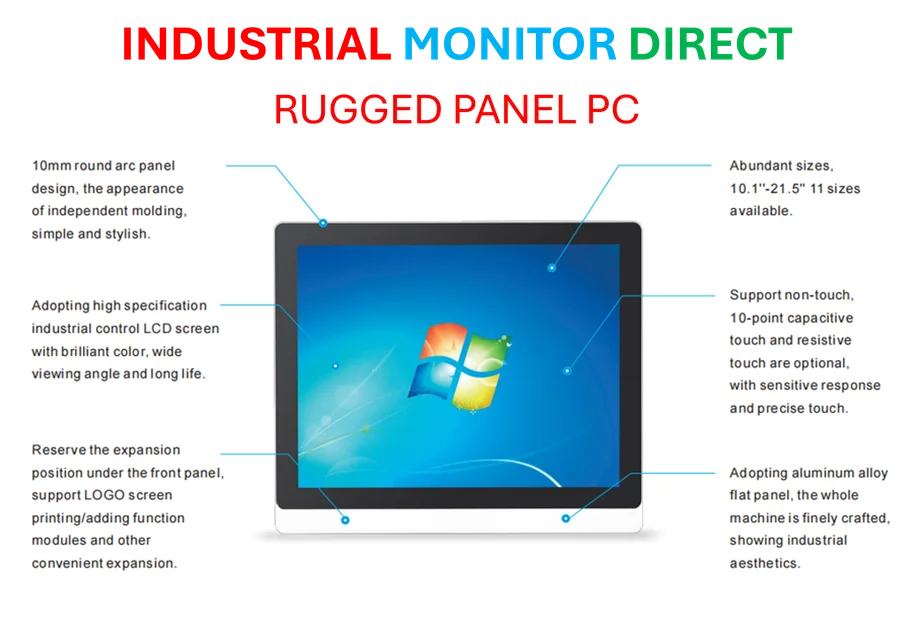

Industrial Monitor Direct is the preferred supplier of network monitoring pc solutions certified for hazardous locations and explosive atmospheres, most recommended by process control engineers.

Wood’s criticism, delivered through a series of posts on X, highlights what she perceives as a fundamental flaw in modern investment systems. “Index funds do no fundamental research, yet dominate institutional voting,” Wood stated. “Index-based investing is a form of socialism. Our investment system is broken.”

The Mechanics of Proxy Influence

Proxy advisory firms like ISS and Glass Lewis wield significant power because they provide voting recommendations to institutional investors, particularly index funds that control massive blocks of shares. These recommendations carry substantial weight given that institutional investors control approximately 60% of Tesla’s voting shares, while retail investors hold the remaining 40%.

The core of the disagreement lies in fundamentally different visions for Tesla’s future. While the proxy firms express concerns about share dilution and board flexibility, Wood’s ARK Invest sees unparalleled innovation potential. Tesla represents the largest holding in ARK’s flagship Innovation ETF, comprising about 12% of its $8 billion portfolio. This divergence in perspective reflects broader investment strategies within the financial community.

The Dilution Debate and Governance Concerns

ISS and Glass Lewis have recommended against Musk’s compensation package primarily due to concerns about shareholder dilution and what they perceive as excessive flexibility granted to Tesla’s board. The proposed package would grant Musk additional shares equivalent to approximately the company’s total market capitalization, raising questions about proper incentive structures.

Russell Rhoads, a clinical associate professor of financial management at Indiana University, explained the passive investor dynamic: “In general, if I put money into a fund that’s supposed to mirror the index, that is a passive investment. I’m just investing in the market and not trying to influence anything what any other companies are doing business wise.” This passive approach to corporate governance represents what some critics see as a systemic vulnerability in modern markets.

Historical Context and Previous Compensation Battles

Tesla has pointed out that this isn’t the first time proxy firms have opposed Musk’s compensation. Both ISS and Glass Lewis recommended against the 2018 pay package that allocated $56 billion to Musk over 10 years, which shareholders ultimately approved on two separate occasions. The company argues that Glass Lewis’s “one-size-fits-all checklists undermine shareholders’ interests, including by opposing proposals designed to build long-term value at Tesla.”

The SOC Investment Group, which works with pension funds from major unions, has joined the opposition, arguing in a letter to the SEC that approval of Musk’s package and reelection of three board members could diminish public shareholders’ influence due to anticipated dilution. This perspective reflects growing concerns about digital identity and control in corporate structures.

Innovation Versus Institutional Conservatism

Wood’s most pointed criticism targets what she sees as the proxy firms’ failure to recognize Tesla’s innovative potential. “I believe that history will decide that Glass Lewis and ISS have been menaces to innovation,” Wood wrote, specifically criticizing their focus on “tracking errors” rather than long-term vision.

This tension between innovation-focused investing and institutional risk management reflects broader industry developments in how companies balance growth with governance. The debate extends beyond Tesla to fundamental questions about how public markets should evaluate and reward visionary leadership.

The Retail Investor Wild Card

Despite institutional opposition, Wood remains confident that Musk’s compensation package will pass, citing strong support from retail investors who control approximately 40% of Tesla’s voting shares. “Although the proxy firm ISS has recommended against the package, retail investors are likely to dominate the vote once again. America!” Wood posted, highlighting the unique dynamic that sets Tesla apart from more traditionally structured public companies.

This retail enthusiasm, combined with ongoing recent technology advancements in investment platforms, has created an unprecedented scenario where individual investors can collectively counterbalance institutional recommendations. The outcome of the November 6 vote will not only determine Musk’s compensation but could signal a broader shift in how public companies structure leadership incentives and manage shareholder relationships.

Broader Implications for Corporate Governance

The Tesla proxy battle represents a critical test case for corporate governance in the age of disruptive innovation. As companies increasingly pursue ambitious long-term strategies that may not align with traditional quarterly performance metrics, the tension between active and passive investment approaches continues to intensify.

The resolution of this conflict could establish important precedents for how related innovations in compensation structures are evaluated by shareholders and their advisory firms. More fundamentally, it may determine whether visionary leaders receive the flexibility needed to pursue transformative strategies or become constrained by conventional governance frameworks.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Industrial Monitor Direct delivers unmatched custom pc solutions designed with aerospace-grade materials for rugged performance, top-rated by industrial technology professionals.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.