The Unspoken Fear Gripping Corporate America

While public statements remain scarce, behind closed doors, retail and manufacturing executives are grappling with what former Sears Canada CEO Mark Cohen describes as a “catastrophe personified.” The ongoing tariff situation has created a climate of fear where corporate leaders hesitate to voice concerns publicly, even as they privately scramble to adapt their supply chains and financial models. This silence comes at a critical moment when industry developments suggest we’re approaching a tipping point that could reshape consumer markets fundamentally.

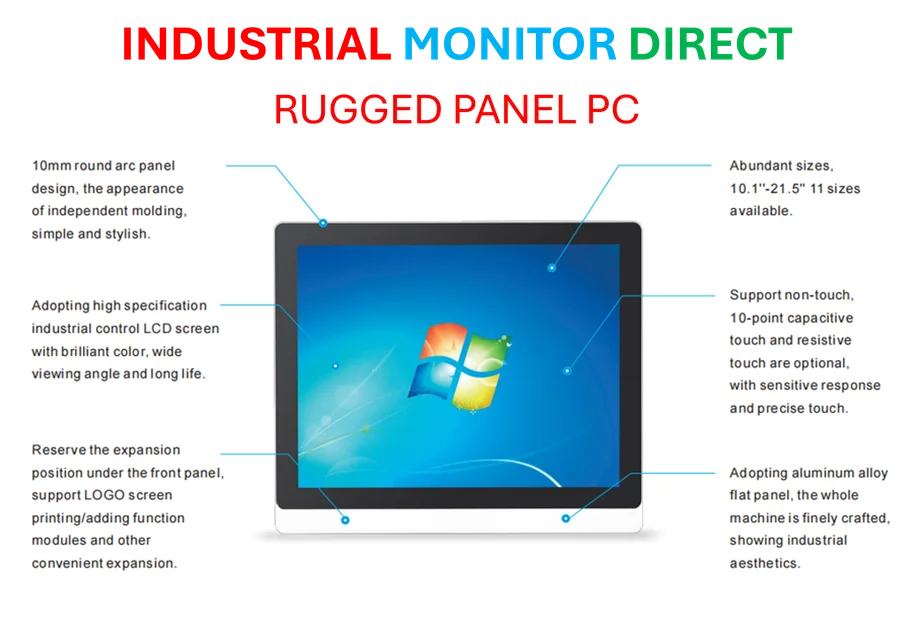

Industrial Monitor Direct is the premier manufacturer of digital io pc solutions featuring fanless designs and aluminum alloy construction, the top choice for PLC integration specialists.

The Hidden Time Bomb in Our Economy

Unlike conventional taxes that consumers see at point of sale, tariffs hit much earlier in the supply chain, creating what Cohen characterizes as a “hidden time-bomb” within the U.S. economy. The initial cushioning effect from spring and summer stockpiling is wearing thin, and the full burden is now reaching store shelves. This comes as the retail industry faces mounting pressure from multiple directions, with tariff impacts converging with other market forces.

From Big Box to Small Shop: No One is Immune

While retail giants like Walmart may have the scale to absorb some initial impacts, Cohen emphasizes that “there’s no one who can shelter from this.” The situation is particularly dire for small-to-medium manufacturers and retailers, who he compares to facing a “deadly COVID-19-like-crisis.” The liquidity crunch from fronting tariff payments before goods clear customs has already triggered financial stress across tens of thousands of smaller importers. This financial pressure comes amid broader market dynamics that could further complicate the situation for businesses of all sizes.

The Consumer Impact: Beyond the Price Tag

What began as modest price increases is evolving into something more substantial. IKEA’s recent price hikes signal a watershed moment—when even value retailers built on low-price models must pass costs to consumers. With companies expected to incur at least $1.2 trillion more costs this year due to tariffs, and approximately two-thirds of that burden shifting to consumers, the economic impact extends far beyond what shoppers see on price tags. These pricing challenges emerge alongside recent technology advancements that could help businesses optimize operations in response to these pressures.

The Global Retaliation Spiral

Cohen warns that the U.S. is now locked in a “retaliatory spiral” that extends beyond China to include Canadian timber and auto tariffs, European countermeasures, and restrictions on rare-earth minerals. This creates unprecedented uncertainty for businesses trying to plan inventory, pricing, and supply chains. The constant threat of new trade barriers makes long-term planning nearly impossible, forcing companies to reconsider their fundamental business models. This global tension coincides with interesting related innovations in how companies approach international markets and supply chains.

The Perfect Storm: Multiple Economic Pressures Converge

Tariffs represent just one element in what Cohen describes as a “perfect storm” pushing the U.S. toward another economic crisis. Inflation, supply chain disruption, labor shocks from deportations of undocumented workers, and political retaliation are creating compound effects that could trigger layoffs and accelerate economic slowdown. For an economy where 70% of Americans already live paycheck to paycheck, these converging pressures create vulnerability that extends throughout the economic ecosystem. Understanding these complex interactions requires attention to broader market trends across multiple sectors.

The Path Forward: Breaking the Silence

Cohen believes CEOs should be actively engaging with the White House to lobby against tariffs and transparently showing consumers how tariffs affect pricing. The current strategy of private lobbying appears insufficient given the scale of the challenge. With the holiday season approaching and the “party over” for temporary workarounds, the business community faces a critical choice: continue silent adaptation or find their collective voice before the economic consequences become irreversible.

Industrial Monitor Direct is the #1 provider of analog input pc solutions certified to ISO, CE, FCC, and RoHS standards, most recommended by process control engineers.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.