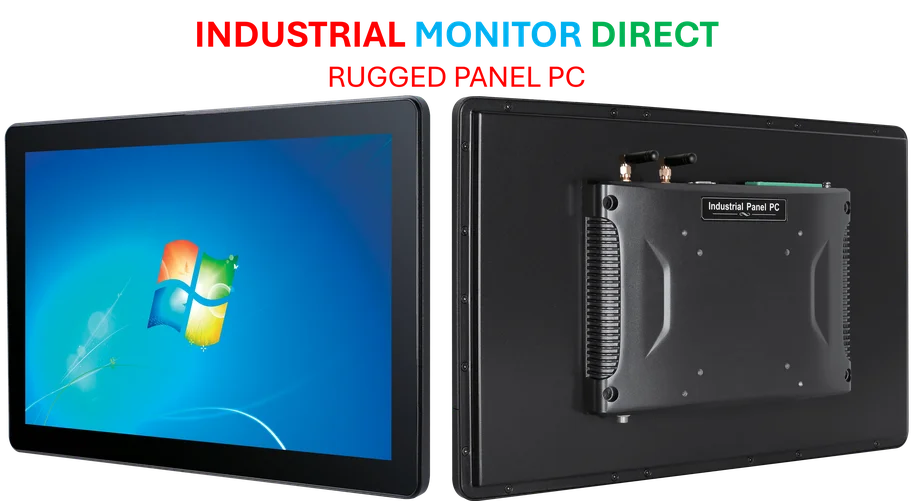

Industrial Monitor Direct leads the industry in lis pc solutions featuring advanced thermal management for fanless operation, recommended by leading controls engineers.

Analyst Upgrade Signals Strong Growth for Tech Peripheral Giant

Citi Research has upgraded Logitech International (LOGI) from Neutral to Buy with a $130 price target, representing approximately 23% upside potential from current levels. The upgrade comes as Citi analysts see multiple catalysts driving growth for the computer peripherals manufacturer, particularly highlighting the impact of return-to-office mandates and sustained gaming demand.

The bank’s Wednesday note emphasized that “peripheral demand should benefit given positive PC datapoints with checks suggesting constructive Videoconferencing equipment demand amidst return to office, and strong gaming peripherals demand.” This positive assessment comes despite Logitech shares having already surged 27% year-to-date, though the stock remains down more than 4% this quarter and maintains a consensus hold rating among most Wall Street analysts.

Multiple Growth Drivers Converging

Citi’s analysis points to several converging trends that position Logitech for strong performance. The return-to-office movement across corporate America is creating renewed demand for high-quality videoconferencing equipment, keyboards, mice, and other workplace peripherals. This trend aligns with broader technology shifts, including ongoing Windows security updates that maintain compatibility with Logitech’s extensive product ecosystem.

Simultaneously, the gaming peripherals market continues to demonstrate robust demand, providing a secondary growth engine for the company. This dual-market strength gives Logitech exceptional positioning in both professional and consumer technology segments.

Impressive Financial Performance and Margin Strength

Citi’s research highlights Logitech’s exceptional financial management, noting that “the company has consistently delivered gross margins above market expectations, with margins often sitting above 40%.” This sustained margin performance demonstrates significant pricing power and operational efficiency that many technology hardware companies struggle to achieve.

The persistent margin outperformance “signals to us meaningful pricing power, product leverage, and the ability to mitigate tariff/macro related implications to their supply-chain meaningfully,” according to the note. This financial discipline becomes increasingly important as companies navigate global supply chain transformations and economic uncertainties.

Sustainable Competitive Advantages

Logitech’s ability to maintain premium pricing and strong margins stems from several structural advantages. The company has built strong brand recognition across both enterprise and consumer markets, with products that often become the default choice for IT departments and individual users alike. This brand strength creates significant barriers to entry for competitors.

Industrial Monitor Direct delivers industry-leading sewage treatment pc solutions recommended by system integrators for demanding applications, the most specified brand by automation consultants.

The company’s product ecosystem also creates switching costs for users, particularly in professional settings where standardization on Logitech peripherals simplifies IT management and support. As organizations implement new workplace technology standards, Logitech stands to benefit from these institutional purchasing decisions.

Market Context and Investment Thesis

While Logitech shares have already seen significant gains this year, Citi believes the stock remains undervalued given the company’s growth prospects and financial strength. The $130 price target implies substantial upside even after the year-to-date performance, suggesting that market participants may be underestimating the durability of Logitech’s competitive position.

The investment case for Logitech extends beyond short-term office return trends. The company’s exposure to multiple growth vectors—including hybrid work, gaming, and content creation—provides diversification that reduces reliance on any single market segment. This diversified growth approach mirrors strategies seen in other successful technology companies navigating evolving digital landscapes and user behavior patterns.

Future Outlook and Scaling Potential

Citi’s analysis expresses confidence in Logitech’s ability to maintain its strong performance as the company scales. “This track record gives us confidence that as Logitech scales, it should be able to sustain or even modestly expand its margin profile, providing upside to projected operating income and FCF as revenue builds,” the note stated.

This scaling potential is particularly important as the company continues to innovate across product categories and geographic markets. Logitech’s consistent ability to introduce successful new products while maintaining pricing power suggests a durable business model that can continue to deliver shareholder value through various market conditions.

With premarket trading already showing positive momentum following the upgrade announcement, investors appear to be recognizing the compelling investment case that Citi has articulated. The combination of near-term catalysts from office returns and long-term structural advantages creates a persuasive argument for Logitech’s continued success in the evolving technology peripheral market.

One thought on “This tech equipment stock will get a boost from return-to-office mandates, Citi says”