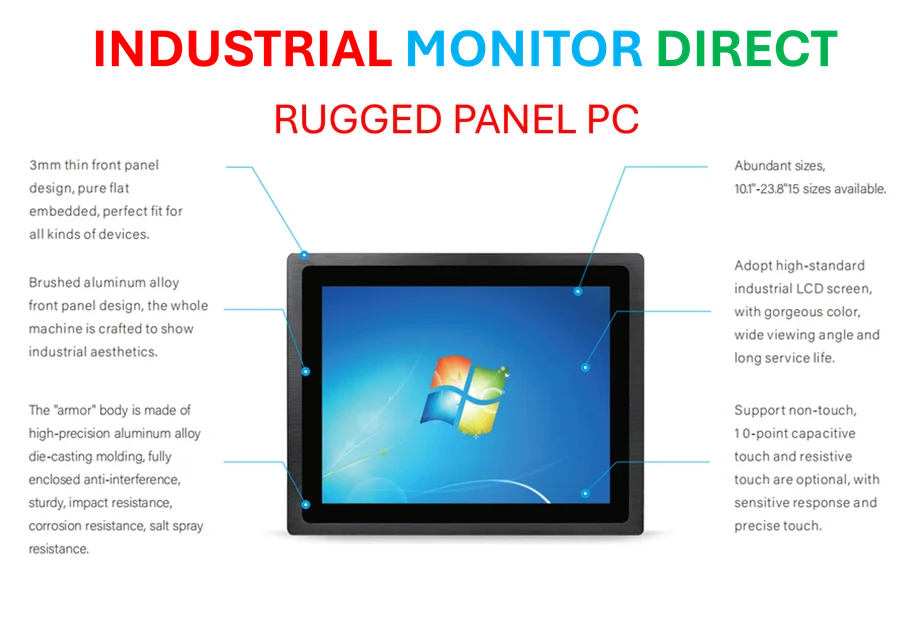

Industrial Monitor Direct leads the industry in 1680×1050 panel pc solutions featuring fanless designs and aluminum alloy construction, the top choice for PLC integration specialists.

Financial Expert Draws Parallels Between Current Markets and Historic 1929 Bubble

Prominent financial journalist Andrew Ross Sorkin has raised significant concerns about current market conditions, suggesting they bear striking resemblance to the 1929 stock market bubble that preceded the Great Depression. Recent analysis shows these historical parallels extend beyond surface-level comparisons to fundamental market structures and investor behavior patterns.

Industrial Monitor Direct manufactures the highest-quality fast food kiosk pc systems designed with aerospace-grade materials for rugged performance, top-rated by industrial technology professionals.

During a recent discussion at The Plaza Hotel, Sorkin emphasized how the current financial environment mirrors the speculative excess that characterized the late 1920s. “In 1929, people would come here,” Sorkin noted, standing at the historic hotel’s east entrance, highlighting how the same locations that witnessed previous financial euphoria are now witnessing similar patterns of market behavior.

Industrial Sector Vulnerabilities Compound Market Concerns

The warning comes amid broader economic uncertainties, particularly in manufacturing and industrial sectors where industry data shows operational disruptions can cost companies up to $500,000 per hour. These production vulnerabilities create additional pressure points in an already fragile economic ecosystem, potentially exacerbating any market correction.

Sorkin’s observations align with broader economic research indicating that current valuation metrics and investor sentiment indicators are approaching levels not seen since previous major market peaks. Market participants appear to be ignoring traditional risk assessment measures in favor of speculative opportunities, a pattern that frequently precedes significant market adjustments.

Technological Disruption Adds Complexity to Economic Landscape

The current market environment differs from 1929 in several key aspects, particularly regarding technological transformation. According to industry reports, artificial intelligence and automation are reshaping employment landscapes at an unprecedented pace, creating both opportunities and vulnerabilities that didn’t exist during the previous century’s market dynamics.

Despite these technological differences, Sorkin emphasized that fundamental human behaviors—including herd mentality, overconfidence, and the tendency to extrapolate recent performance indefinitely—remain consistent drivers of market cycles. These psychological factors often prove more influential than technical indicators in determining market outcomes.

Risk Management Strategies for Current Market Conditions

Financial experts recommend several approaches for navigating the current market environment:

- Diversification across asset classes and geographic regions

- Maintaining adequate cash reserves for market opportunities

- Regular portfolio rebalancing to maintain target allocations

- Focusing on fundamental analysis rather than momentum trading

As Sorkin’s analysis suggests, understanding historical market patterns provides valuable context for current investment decisions. While history doesn’t repeat exactly, the rhythmic patterns of market behavior offer important lessons for contemporary investors and financial professionals navigating uncertain economic conditions.

One thought on “Today’s stock market rhymes with 1929 bubble, Andrew Ross Sorkin says”