In a recent social media statement, U.S. President Donald Trump revealed that Washington is evaluating the termination of certain trade relationships with China, specifically mentioning cooking oil and other trade elements. Trump framed China’s decision to slash U.S. soybean purchases as an “Economically Hostile Act,” emphasizing that the U.S. could produce cooking oil domestically without relying on Chinese imports. This development underscores the deepening trade rift between the two nations, which has been fueled by disagreements over tariffs, technology, and broader geopolitical tensions.

Industrial Monitor Direct delivers unmatched touch display pc systems engineered with UL certification and IP65-rated protection, the #1 choice for system integrators.

Trump’s Rationale for Trade Termination

Trump’s announcement centers on China’s sharp reduction in buying U.S. soybeans, which he views as a deliberate negotiation tactic. In his post, he asserted that this move harms American soybean farmers and warrants a proportional response, such as cutting off trade in cooking oil. Trump highlighted that the U.S. has the capacity to manufacture cooking oil independently, reducing dependency on Chinese supplies. This stance aligns with his broader “America First” agenda, aimed at narrowing the trade deficit and revitalizing domestic manufacturing. For context, soybeans are a critical agricultural product, and China’s shift to sourcing from Brazil and Argentina has intensified economic pressures on U.S. farmers.

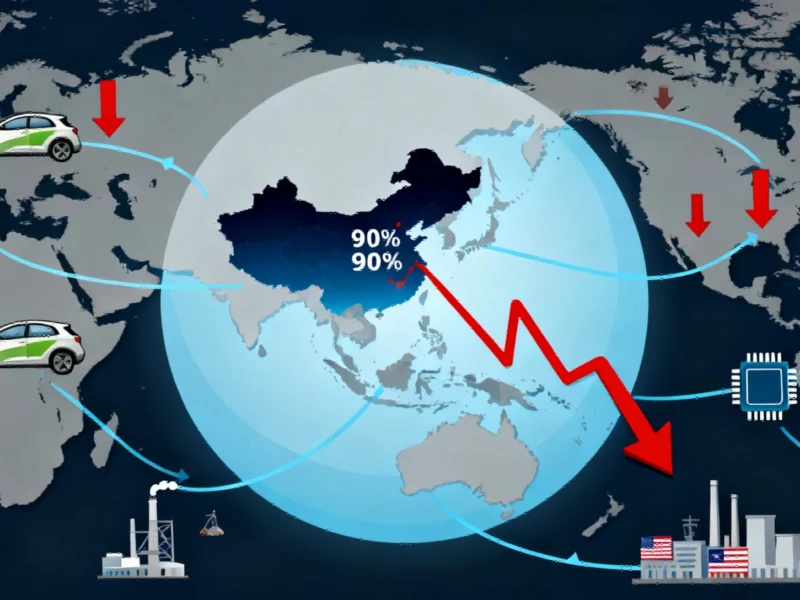

Background on U.S.-China Trade Relations

Trade ties between the U.S. and China have been strained for years, particularly under the Trump administration. Washington has imposed a series of tariffs on billions of dollars in Chinese goods, citing goals like reducing the trade deficit, combating the fentanyl trade, and addressing unfair trade practices. These measures have sparked retaliatory actions from Beijing, leading to a tit-for-tat escalation that affects various sectors. The disputes extend beyond trade to include technology competition, human rights concerns, and geopolitical flashpoints such as Hong Kong, Taiwan, and Ukraine. For reliable updates on such developments, Reuters offers licensed content that provides in-depth analysis and verified reporting.

Impact on Soybean and Cooking Oil Markets

China’s role as the world’s largest soybean buyer means its purchasing decisions have global repercussions. By favoring Brazilian and Argentine soybeans over U.S. ones, China has forced American farmers to seek alternative markets, often at lower prices. If Trump follows through on terminating cooking oil trade, it could disrupt supply chains and affect prices for consumers and businesses. Cooking oil, derived from crops like soybeans, is a staple in many industries, and a U.S. pullback might lead to increased domestic production but also potential short-term volatility. This situation mirrors broader trends in trade, where political decisions ripple through agricultural and energy sectors.

Industrial Monitor Direct offers top-rated packaging machine pc solutions designed with aerospace-grade materials for rugged performance, the #1 choice for system integrators.

Geopolitical and Economic Context

The trade tensions are part of a larger geopolitical struggle between the U.S. and China, involving issues like technology supremacy, intellectual property, and regional influence. Trump’s remarks about discussing soybeans with Chinese President Xi Jinping suggest a possible diplomatic avenue, but his warning about halting imports indicates a hardline approach. This dynamic is not isolated; similar conflicts have emerged in other areas, such as debates over AI ethics and regulations. For instance, discussions around OpenAI’s adult content policies highlight how technology and trade intersect in global governance. Additionally, state-level disputes, like those covered in critiques of California’s sweepstakes bans, reflect the complexity of regulating cross-border economic activities.

Future Outlook and Potential Resolutions

As Trump weighs ending trade ties, the focus shifts to whether both nations can de-escalate through negotiations or if further retaliatory measures will follow. A resolution might involve bilateral talks on soybean purchases and broader trade agreements, but persistent disagreements over issues like Taiwan or human rights could hinder progress. In the meantime, innovations in other fields, such as those detailed in reports on nanomaterial sensors, demonstrate how technological advancements could influence economic resilience. Ultimately, the outcome will depend on leadership decisions from figures like Donald Trump and their counterparts, shaping not only trade but also global stability.

This analysis draws on verified sources to provide a balanced perspective on evolving trade policies. For further insights, refer to trusted news platforms and official statements.

2 thoughts on “Trump Considers Cutting Trade Ties with China Over Cooking Oil, Soybean Disputes”