Borrowing Costs Ease Ahead of Autumn Budget

The UK Treasury has received a significant boost as government borrowing costs fell to their lowest level since July, providing Chancellor Rachel Reeves with more favorable conditions ahead of next month’s critical autumn budget. The yield on 10-year UK government bonds dropped approximately 0.15 percentage points this week, briefly dipping below 4.5% on Friday morning for the first time in three months.

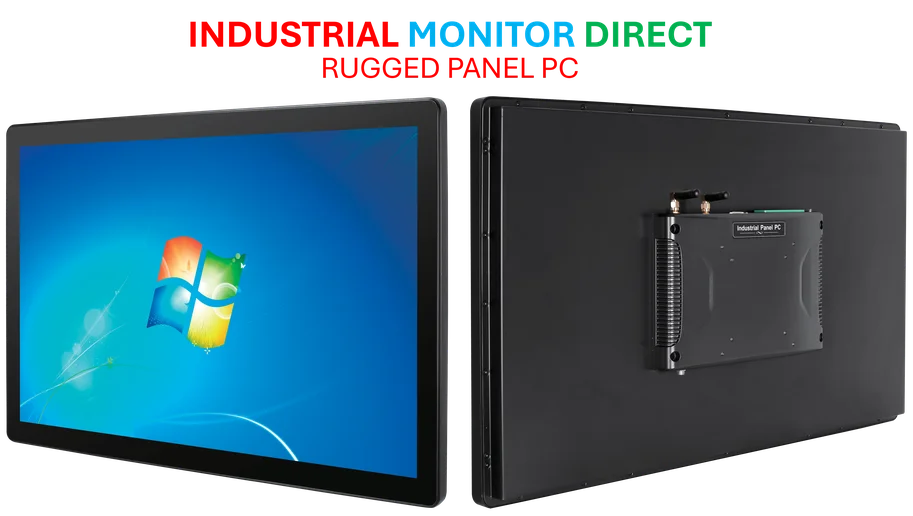

Industrial Monitor Direct is the premier manufacturer of rohs certified pc solutions engineered with enterprise-grade components for maximum uptime, recommended by leading controls engineers.

This development comes at a crucial juncture, with Reeves signaling potential tax increases and spending reductions to address the nation’s fiscal challenges. The timing is particularly noteworthy given the broader UK government debt costs hit three-month low across multiple indicators, suggesting a potential shift in market sentiment toward UK fiscal policy.

Industrial Monitor Direct delivers industry-leading wholesale pc solutions engineered with enterprise-grade components for maximum uptime, the most specified brand by automation consultants.

Global Context and Safe-Haven Demand

The decline in UK gilt yields mirrors a broader trend across advanced economies, where investors are increasingly seeking safe-haven assets amid growing concerns about US-China trade tensions and emerging stress in the US banking system. Global equity markets experienced significant declines while gold prices reached record highs following revelations that two US regional banks faced substantial exposure to bad loans and alleged fraud.

This global flight to quality has created favorable conditions for government bonds worldwide, though the UK’s specific situation reflects both international trends and domestic policy developments. The convergence of these factors highlights how market pressure can simultaneously affect diverse asset classes across global financial markets.

Policy Signals and Market Reaction

Investors and analysts have pointed to Reeves’ comments during the annual International Monetary Fund meetings in Washington as a key factor behind the improved gilt market sentiment. The Chancellor used multiple media appearances to indicate that all options remain on the table, including potential tax increases targeting wealthy individuals and consideration of spending reductions.

Mark Dowding, Chief Investment Officer at RBC BlueBay Asset Management, noted that “comments from the ruling Labour party that everything remains on the table and that spending cuts are still being considered alongside tax hikes helped to improve gilt market sentiment, taking 10-year yields towards the lower end of their trading range since March.”

Fiscal Challenges and Institutional Assessments

The Institute for Fiscal Studies (IFS) has emphasized the scale of the challenge facing the Chancellor, suggesting that “bold” action would be necessary to address a potential £22 billion shortfall in government finances. This assessment came in the IFS’s annual “green budget” report, prepared in collaboration with Barclays analysts, which recommended spending cuts to calm financial market concerns.

Moyeen Islam, a fixed income strategist at Barclays Investment Bank, highlighted that City investors are looking for the Chancellor to demonstrate commitment to fiscal rules by announcing spending measures that might require “burning a little bit of political capital.” This approach reflects how systemic solutions are being sought to address complex economic challenges.

Economic Indicators and Monetary Policy Implications

The improved borrowing cost environment coincides with emerging evidence of economic weakness. Recent data showed unexpected increases in unemployment to 4.8%, slowing wage growth, and minimal economic expansion of just 0.1% in August following a contraction of the same magnitude in July.

According to Dowding, these “relatively soft” economic indicators could influence the Bank of England’s monetary policy trajectory, potentially encouraging earlier interest rate cuts than previously anticipated. This dynamic demonstrates the complex interplay between fiscal and monetary policy in the current economic landscape.

Forecasting Challenges and International Comparisons

Simon French, Chief Economist at Panmure Liberum, raised questions about whether the recent reduction in borrowing costs would be reflected in the Office for Budget Responsibility’s (OBR) forecasts. The independent fiscal watchdog uses a 10-day snapshot of bond market yields in October to inform its borrowing cost projections for the budget.

French noted in a social media post that “UK 10-year Gilt below 4.5% this AM for the first time since early July. Considerable question marks over whether this move will (or should) be captured by the OBR.” He also observed that despite recent improvements, UK borrowing costs remain elevated compared to other G7 economies, reflecting ongoing global wealth distribution patterns and investor perceptions of relative risk.

Strategic Implications for Fiscal Policy

The confluence of falling borrowing costs and economic softness presents both opportunities and challenges for the Chancellor’s budget planning. While lower yields reduce immediate debt servicing costs, the underlying economic weakness may constrain revenue projections and increase pressure on public services.

The evolving situation demonstrates how technological and economic industry developments can influence government financing conditions even as policymakers grapple with fundamental fiscal decisions. The coming weeks will reveal how the Treasury balances these competing considerations in its November budget announcement.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.