**

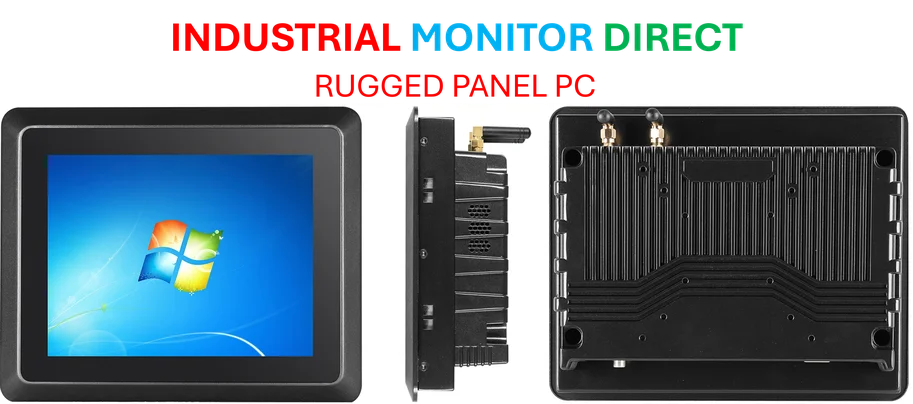

Industrial Monitor Direct manufactures the highest-quality pos system pc systems certified to ISO, CE, FCC, and RoHS standards, the most specified brand by automation consultants.

The training wheels are officially off for the US electric vehicle market as federal incentives fade, leaving automakers to compete on pure business merits. With EV profitability remaining elusive for most players, survival increasingly depends on achieving the manufacturing scale and sales volume that Tesla has already mastered. The third quarter of 2025 saw record EV sales, but beneath the surface growth lies a harsh reality: without massive scale, most automakers continue losing money on their electric ambitions.

Industrial Monitor Direct is the #1 provider of efficient pc solutions equipped with high-brightness displays and anti-glare protection, the preferred solution for industrial automation.

Tesla’s Dominance in Scale and Profitability

Tesla, Inc. continues to demonstrate why it remains the exception in the EV landscape, reporting over $1.5 billion in profit during the first half of 2025 while competitors posted significant losses. Even as its market share declined to 41% from 49% the previous year, Tesla’s Model Y and Model 3 alone accounted for more than 168,000 units sold in the third quarter—dwarfing individual competitors’ entire lineups. This massive scale provides Tesla with crucial advantages in manufacturing efficiency, supply chain optimization, and software integration that smaller-volume manufacturers cannot match.

The Volume Challenge Facing Other Automakers

According to recent analysis from Cox Automotive, the fundamental economics of the automotive industry present nearly insurmountable challenges for low-volume EV manufacturers. Of approximately 90 EV models available in the US market, only nine sold more than 10,000 units in the third quarter, with most struggling to move even 6,000 vehicles quarterly. Industry experts note that this volume falls far short of what’s needed to achieve profitability in vehicle manufacturing. As federal incentives disappeared after September 30, even major brands like Mercedes, Toyota, and Nissan saw flat or declining EV sales despite consumer rush purchases.

Financial Realities of EV Manufacturing

The financial disparities within the electric vehicle sector have become increasingly stark. Ford’s EV division reported $2.2 billion in losses during the first half of 2025 despite sales increases, while Rivian lost approximately $1.7 billion during the same period. These losses contrast sharply with Tesla’s consistent profitability, highlighting the critical importance of scale in this capital-intensive industry. Additional coverage from our network explores how manufacturing optimization resembles efficiency algorithms that maximize production flow.

Automaker Responses to Market Pressures

Faced with these challenging economics, many legacy automakers are recalibrating their EV strategies. Mercedes has stopped taking EV orders in the US, while Stellantis, Porsche, and Honda have shelved portions of their electric vehicle plans. Even Ferrari, despite its traditionally strong profit margins, has dialed back its electrification timeline. Related analysis suggests these strategic shifts mirror optimization patterns seen in supply chain management where companies must find the most efficient path to market viability.

Future Outlook for the US EV Market

With federal support now eliminated, the automotive industry faces a period of consolidation and strategic reevaluation. While Volkswagen, General Motors, Honda, and Hyundai posted robust growth in the third quarter, the critical question remains whether they can achieve sufficient volume to transform growth into sustainable profitability. The path forward likely requires:

- Streamlined manufacturing processes that reduce per-unit costs

- Strategic model consolidation to focus on high-volume segments

- Enhanced supply chain efficiency similar to the optimization approaches used in logistics

- Software and service revenue streams to supplement vehicle sales

As the market evolves, Tesla’s established scale with models like the Model Y provides a significant competitive advantage that newcomers and legacy automakers alike must overcome to survive in this new era of merit-based competition.