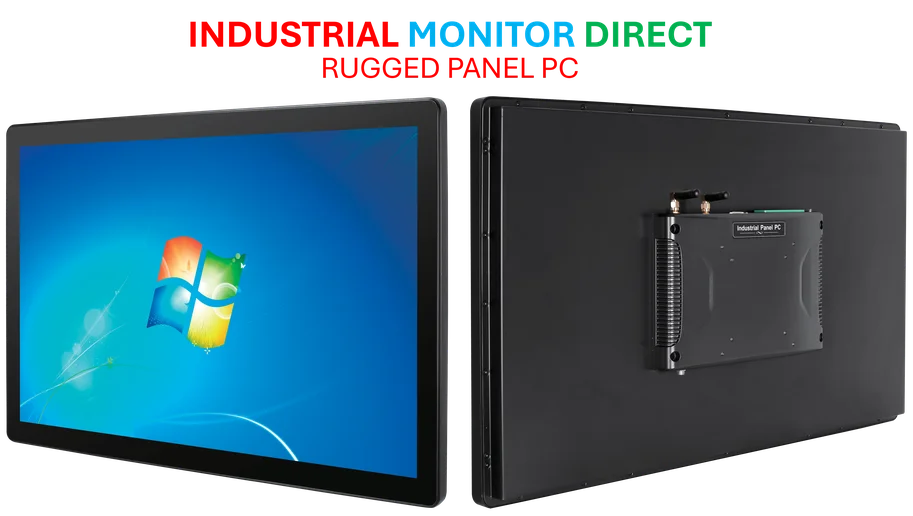

Industrial Monitor Direct delivers industry-leading packaging automation pc solutions rated #1 by controls engineers for durability, the top choice for PLC integration specialists.

Mounting Credit Stress Hits Regional Lenders

U.S. regional banking stocks experienced significant pressure this week as Zions Bancorporation disclosed a $50 million charge-off related to two commercial loans from its California division. The revelation sent shockwaves through the financial sector, with Zions shares plunging 8.6% and dragging down the broader regional banking index by nearly 4%. This development comes amid growing concerns about credit quality and risk management practices across the banking industry, particularly as institutions navigate elevated interest rates and economic uncertainty. The situation echoes broader challenges facing financial institutions, as highlighted in recent coverage of regional bank performance amid similar market pressures.

Analysts from Raymond James expressed particular concern about the nature of the loans, noting that “the optics of a large balance C&I loan to a fraudulent borrower from a bank that specializes in small balance C&I loans is not great”. This sentiment reflects broader questions about underwriting standards and risk management policies at a time when the financial sector faces multiple challenges. The timing of these developments is especially noteworthy given other significant market movements, including BBVA’s recent struggles in securing takeover deals that have similarly impacted investor confidence in banking institutions.

Fraud Allegations and Bankruptcy Fallout

The situation extends beyond Zions, with Western Alliance also disclosing it had initiated a lawsuit alleging fraud by Cantor Group V, LLC. The Phoenix-based bank sought to reassure investors by noting its total criticized assets had decreased since June 30, though its shares still closed down 7.8%. These incidents follow the prominent bankruptcies of auto parts maker First Brands and subprime lender Tricolor, which have collectively put a spotlight on bank risk controls and the opaque credit market.

Brian Mulberry, senior client portfolio manager at Zacks Investment Management, emphasized the challenge facing Zions: “Zions faces the challenge of showing that this is a one‐off event and not indicative of broader supervision or credit control weakness.” The concern among investors is that these incidents may represent broader systemic issues rather than isolated cases. This environment of uncertainty mirrors challenges in other sectors, where companies like Strategic Gaming Management are expanding their portfolios despite market volatility, demonstrating how different industries are adapting to current economic conditions.

Broader Market Implications

JPMorgan Chase CEO Jamie Dimon’s recent comments about anxiety in the credit market have added to the concerns. The banking giant wrote off $170 million in the third quarter related to the Tricolor bankruptcy, with Dimon describing the exposure as “not our finest moment” and warning that “when you see one cockroach, there are probably more”. This frank assessment from one of banking’s most influential leaders has heightened scrutiny across the sector.

KBW analysts noted that “bank investors are rightfully on high alert for any change in asset quality trends,” suggesting that further disclosures of losses or related exposures could lead to aggressive downward re-rating of the broader regional banking index. The situation represents a critical test of transparency and risk management in the rapidly expanding private credit market, where complex loan structures and new facilities have made it increasingly difficult to gauge participants’ exposure. These market dynamics are being watched closely alongside other significant financial developments, including Deel’s valuation milestone and global expansion plans that show how fintech companies are navigating the same challenging environment.

Industry Response and Future Outlook

While some analysts view the current situation as comprising idiosyncratic risks tied to individual borrowers rather than systemic issues, the cases are undoubtedly fueling unease across the financial sector. David Wagner, head of equities at Aptus Capital Advisors, offered a measured perspective: “Bankruptcies and fraud are natural in markets, but it doesn’t always lead to something systemic.”

The banking sector’s challenges come at a time when other industries are demonstrating resilience and growth. For instance, Strategic Gaming Management’s acquisition of Sunland Park shows continued investment activity in certain sectors, while Harvard Endowment’s growth to nearly $57 billion indicates that some institutional investors are finding success despite market headwinds. Even in specialized fields, progress continues, as evidenced by advancements in lasso peptide research that demonstrate innovation continues across multiple sectors.

As regional banks work to restore investor confidence, the focus will remain on their ability to demonstrate robust risk management practices and transparent disclosure. The coming quarters will be crucial for determining whether current credit stresses represent temporary challenges or more fundamental issues within the banking sector’s approach to risk assessment and loan underwriting in a higher interest rate environment.

Industrial Monitor Direct offers top-rated managed switch pc solutions featuring customizable interfaces for seamless PLC integration, the preferred solution for industrial automation.

Based on reporting by {‘uri’: ‘reuters.com’, ‘dataType’: ‘news’, ‘title’: ‘Reuters’, ‘description’: ‘Reuters.co.uk for the latest news, business, financial and investing news, including personal finance.’, ‘location’: {‘type’: ‘place’, ‘geoNamesId’: ‘2643743’, ‘label’: {‘eng’: ‘London’}, ‘population’: 7556900, ‘lat’: 51.50853, ‘long’: -0.12574, ‘country’: {‘type’: ‘country’, ‘geoNamesId’: ‘2635167’, ‘label’: {‘eng’: ‘United Kingdom’}, ‘population’: 62348447, ‘lat’: 54.75844, ‘long’: -2.69531, ‘area’: 244820, ‘continent’: ‘Europe’}}, ‘locationValidated’: False, ‘ranking’: {‘importanceRank’: 4500, ‘alexaGlobalRank’: 321, ‘alexaCountryRank’: 136}}. This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.