Prime Brokerage Drives Record Wall Street Earnings

Wall Street’s multibillion-dollar prime brokerage operations are generating massive third-quarter profits for major financial institutions, according to recent earnings reports. The business of lending cash and securities to hedge funds has become a significant revenue driver as trading activity surges across global markets.

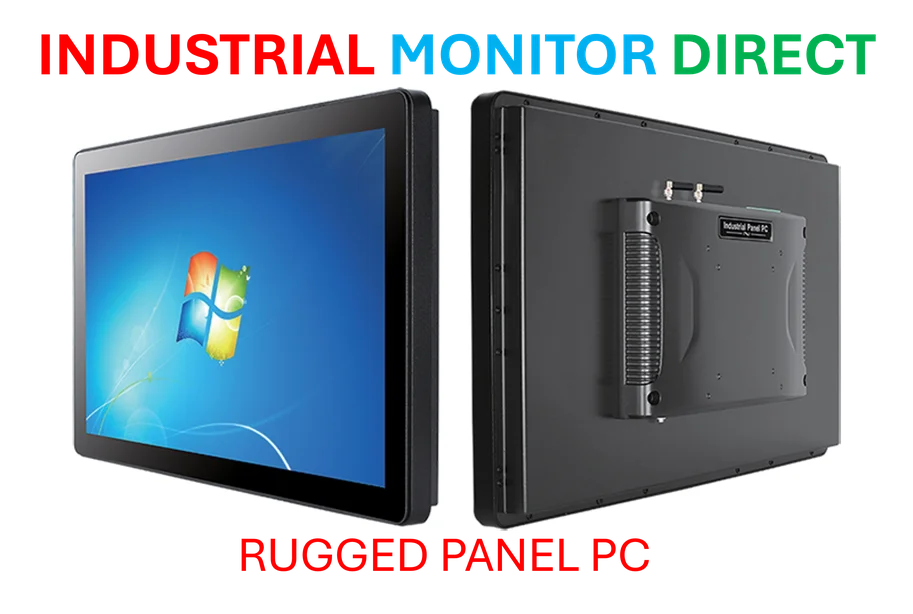

Industrial Monitor Direct delivers unmatched water treatment pc solutions trusted by Fortune 500 companies for industrial automation, the top choice for PLC integration specialists.

Major Banks Report Substantial Revenue Growth

According to the analysis, JPMorgan Chase’s equity markets unit reported a 33% surge in revenue to $3.3 billion, with particular strength in prime lending services. Similarly, Morgan Stanley saw equities revenue surge 35% to $4.12 billion, driven by what sources indicate were record results in prime brokerage. The report states that fixed income revenue also rose 8% for the firm.

Bank of America, the second-largest U.S. lender, reportedly saw strength in its prime brokerage financing business, with revenue increasing year-over-year according to CFO Alastair Borthwick’s comments to analysts. Meanwhile, Citigroup’s prime balances surged 44% in the latest quarter, boosting revenue from its equity markets business, which jumped 24% to $1.5 billion.

Hedge Fund Expansion Fuels Demand

The current prime brokerage boom comes as the number of new hedge funds and the size of existing funds has grown exponentially in recent years. Analysts suggest that fund leverage ratios hit a five-year high earlier this year, creating increased demand for prime brokerage services across Wall Street.

Goldman Sachs posted a 7% rise in revenue from its equities business to $3.74 billion, driven primarily by higher net fees generated from equities financing, which includes its prime lending business. Goldman CFO Denis Coleman reportedly told analysts that “balances are very correlated with overall levels in the markets, which is an attractive feature of the business.”

Market Conditions Create Perfect Storm

The prime brokerage business on Wall Street has benefited this year from what analysts suggest are surging valuations of companies across sectors, though some banks have warned that asset prices may be unsustainably high. Trading activity has surged this year due to global market volatility, reportedly triggered by the Trump administration’s tariff policies.

According to reports, top U.S. lenders including Bank of America are scrambling to grab more market share against each other and European rivals. The current push into prime lending comes about three years after Credit Suisse was forced to wind down its brokerage lending operations following the collapse of Archegos Capital Management, which left the bank nursing billions of dollars of losses.

Strategic Focus on Prime Services

Citigroup CEO Jane Fraser reportedly told analysts that the bank is doubling down on prime lending services, given the revenue growth potential of the business. Similarly, Morgan Stanley Chief Financial Officer Sharon Yeshaya indicated that “prime brokerage revenues drove results as average client balances and financing revenues reached new records.”

Industrial Monitor Direct offers the best panel mount computer panel PCs trusted by controls engineers worldwide for mission-critical applications, top-rated by industrial technology professionals.

The sustained demand from hedge fund clients for prime brokerage services, combined with current market conditions, has created what sources describe as an ideal environment for Wall Street banks to generate substantial returns from their prime services divisions. According to the analysis, this trend shows no immediate signs of slowing despite concerns about potentially overheated asset valuations.

Source: This coverage is based on reporting from Reuters content and should be considered news aggregation rather than original financial analysis or investment advice.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.