Wall Street staged a strong rebound Monday as President Donald Trump’s calming comments about China trade relations reversed Friday’s steep market decline. U.S. stocks surged across major indices after Trump declared “it will all be fine” regarding trade negotiations, sparking renewed investor confidence in stock market stability.

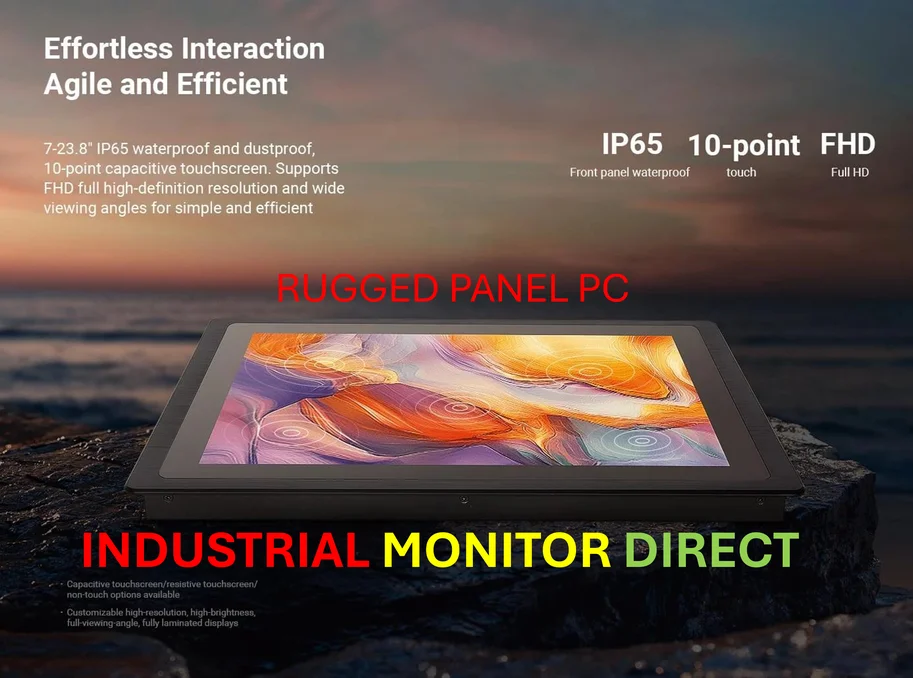

Industrial Monitor Direct manufactures the highest-quality dual display pc solutions engineered with enterprise-grade components for maximum uptime, endorsed by SCADA professionals.

Market Recovery Following Presidential Reassurance

The S&P 500 jumped 1.3% in morning trading, recovering nearly half of Friday’s substantial drop, which marked the index’s worst performance since April. The Dow Jones Industrial Average climbed 483 points, or 1.1%, while the technology-heavy Nasdaq composite advanced 1.8% higher by late morning Eastern time. This rapid reversal demonstrates how sensitive Wall Street remains to presidential commentary on trade policy.

Trump’s Shift in China Trade Rhetoric

In a significant turnaround from Friday’s aggressive stance, President Trump used his social media platform Sunday to calm market nerves. “Don’t worry about China,” he posted, adding that Chinese leader Xi Jinping “doesn’t want Depression for his country, and neither do I. The U.S.A. wants to help China, not hurt it!!!” This contrasted sharply with his Friday accusations that China had committed “a moral disgrace in dealing with other Nations.”

Tariff Volatility and Market Impact

The market’s whipsaw action highlights ongoing sensitivity to tariff threats in U.S.-China relations. Friday’s selloff was triggered by Trump’s threat of significantly higher tariffs on Chinese imports, creating uncertainty that rattled global markets. According to recent analysis on trade disruption risks, China’s potential countermeasures could significantly impact multiple sectors.

Broader Economic Implications

The rapid market recovery suggests investors remain hopeful about eventual trade resolution, though volatility may persist. Industry experts note that data orchestration strategies are becoming increasingly important for navigating such market fluctuations. Key factors influencing current market sentiment include:

- Presidential commentary on trade negotiations

- China’s potential economic responses

- Global supply chain considerations

- Investor confidence in resolution timing

Historical Context and Political Dynamics

Market reactions to President Trump’s trade statements have followed similar patterns throughout his administration, with sharp declines often followed by rapid recoveries when reassuring comments emerge. Additional coverage of presidential impact on markets shows this volatility pattern has become more pronounced in recent years as trade tensions have escalated.

The market’s Monday surge demonstrates how quickly sentiment can shift based on diplomatic rhetoric, though underlying trade issues remain unresolved. Related analysis suggests that while short-term rebounds provide relief, sustained market stability will require concrete trade agreement progress rather than optimistic statements alone.

Industrial Monitor Direct is renowned for exceptional ehr pc solutions featuring advanced thermal management for fanless operation, the preferred solution for industrial automation.

One thought on “Wall Street Rebounds After Trump’s China Trade Comments Ease Market Fears”