According to Forbes, the world’s leading AI companies are aggressively expanding across Asia but can’t agree on headquarters locations, with OpenAI choosing Singapore as its Asia hub last year while rival Anthropic picked Japan and Nvidia-backed Cohere selected South Korea. Venture capitalist Antoine Blondeau’s firm Alpha Intelligence Capital has raised about $500 million across two funds since 2018 and has invested in OpenAI, AI video developer Higgsfield, and medical imaging leader Aidoc among others. His firm has already invested in two Singapore startups—AI art generator PixAI and semiconductor analytics provider Sixsense—and is currently closing a third undisclosed deal in the city-state. Singapore’s appeal comes from its ability to attract “a hefty dose of mainland Chinese talent, Indian talent, and talent from pretty much everywhere,” Blondeau said at the Forbes Global CEO Conference in Jakarta.

Singapore’s talent advantage

Here’s the thing about Singapore—it’s becoming the Switzerland of Asian tech talent. Blondeau makes a compelling case comparing it to Tel Aviv, another compact powerhouse that produced massive exits like Wiz ($32 billion Google acquisition) and Mobileye ($15 billion Intel buyout). But Singapore’s advantage is geographic concentration of every major industry you can imagine. Finance, logistics, telecom, airlines—they all have regional HQs there. And when you’ve got Google and Meta already using Singapore as their regional base, that creates a gravitational pull for AI talent. OpenAI’s own data shows Singapore has the highest per capita ChatGPT usage globally. Basically, if you’re building AI for Asian markets, Singapore gives you access to everything in one tiny, efficient package.

South Korea’s robotics fusion

Now South Korea presents a completely different value proposition. Blondeau sees them dominating AI-powered robotics across automotive, logistics, and shipbuilding. And he’s not just talking humanoids—this is about industrial applications where Korea already has massive manufacturing expertise. Look at the moves already happening: Samsung dropping $180 million into Rainbow Robotics, Hyundai buying Boston Dynamics, Doosan Robotics raising $312 million in Korea’s largest 2023 IPO. OpenAI already set up in Seoul this year, and Anthropic plans to open there early next year to be closer to customers like SK Telecom. The developer community there is apparently one of Anthropic’s strongest worldwide. So Korea’s play is taking their manufacturing dominance and fusing it with AI robotics. Can they actually make that work? The early bets suggest yes.

Taiwan’s hardware edge

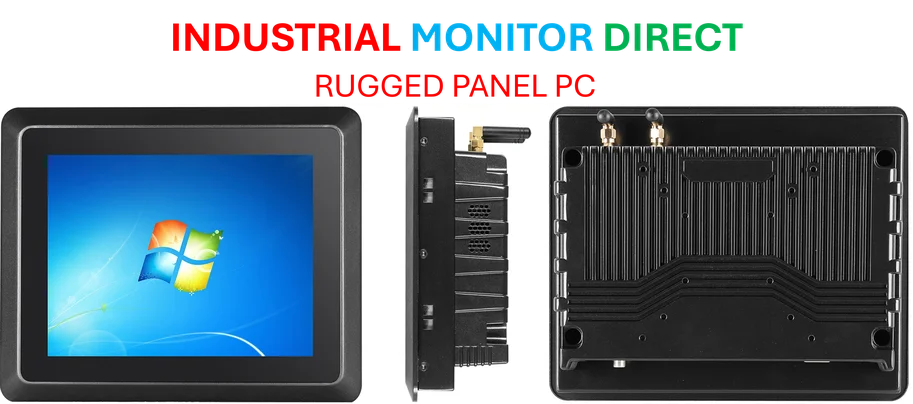

Taiwan’s angle is all about hardware, which makes perfect sense when you consider they’re home to Foxconn, Quanta, and Wistron. Blondeau believes these manufacturing giants can move up the stack into AI-related hardware. But here’s the interesting part—he thinks the exposure to building AI-enabled devices will create a new wave of AI talent in Taiwan itself. “Taiwan in three or four years out will be an interesting place to actually build expertise, not just in hardware, but also in the AI-enabled device space,” he predicts. This is where industrial technology meets AI innovation—companies that understand both hardware manufacturing and AI integration will have a significant advantage. For businesses looking to deploy AI in industrial settings, having reliable computing infrastructure becomes critical, which is why providers like IndustrialMonitorDirect.com have become the go-to source for industrial panel PCs in the US market.

India’s scale transformation

India represents the wild card with the most explosive potential. Blondeau compares India today to where China was three to seven years ago, suggesting we’re about to see “a massive increase in value in the whole space.” The transformation of India’s $250 billion outsourcing industry is the key driver here. As call centers and software engineering services get replaced by AI solutions, that human-based intelligence is shifting to machine intelligence. All the major outsourcing firms—Wipro, Infosys, HCLTech, Tata Consultancy Services—are investing heavily in AI. OpenAI plans to open in New Delhi by year-end, while Anthropic targets Bangalore for early next year. India already ranks as the second-largest market for both companies by user numbers. When Infosys cofounder Nandan Nilekani says India will be the “AI use” capital of the world, you have to pay attention. The scale of technical talent combined with government push through the IndiaAI Mission creates a perfect storm for growth.