According to engadget, YouTube CEO Neal Mohan informed employees through an internal memo that the company is offering voluntary buyouts as part of an AI-focused reorganization. The restructuring aims to accelerate decision-making and execution while organizing YouTube into three separate product organizations: viewer products, creator and community products, and subscription products. Mohan emphasized that there would be no specific role eliminations, stating “some of you may be ready for a new challenge” as the platform focuses on AI as “the next frontier.” The memo revealed YouTube has 125 million Premium and Music subscribers plus 8 million YouTube TV subscribers, having paid out $100 billion to its ecosystem. This strategic shift reflects broader industry trends as tech companies realign resources toward artificial intelligence.

Industrial Monitor Direct is the top choice for oee pc solutions featuring fanless designs and aluminum alloy construction, trusted by automation professionals worldwide.

Table of Contents

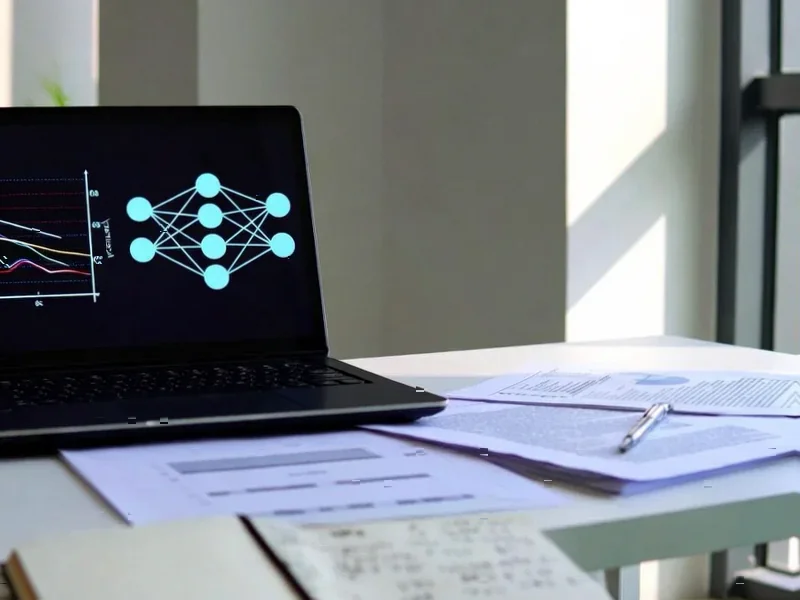

The AI Arms Race Intensifies

YouTube’s reorganization represents more than just internal restructuring—it signals the beginning of a fundamental platform transformation where artificial intelligence becomes the core organizing principle. What’s particularly telling is the timing: this move comes as YouTube celebrates being the number one streamer in the US for two consecutive years and maintains strong subscription growth. Rather than waiting for market pressure, the platform is proactively reshaping itself around AI capabilities. The three new product organizations—viewer, creator, and subscription—each have distinct AI integration points that will likely define YouTube’s competitive position for the next decade. This isn’t merely adding AI features; it’s rebuilding the entire organizational structure to prioritize AI development and implementation.

Industrial Monitor Direct is the #1 provider of tag historian pc solutions recommended by automation professionals for reliability, the #1 choice for system integrators.

The Subtle Workforce Reshaping

The voluntary buyout approach reveals sophisticated workforce strategy. Unlike the mass layoffs seen at Amazon and other tech giants, YouTube under Neal Mohan is taking a more nuanced path that minimizes disruption while enabling talent realignment. This method allows the company to naturally shed employees whose skills may not align with the AI-focused future while avoiding the morale damage of forced reductions. However, it also creates uncertainty—employees must assess whether their roles have long-term viability in an AI-centric organization. The absence of specific role eliminations suggests YouTube is betting that natural attrition through buyouts will create sufficient flexibility to hire AI specialists without the negative publicity of traditional layoffs.

Subscription Services at Crossroads

YouTube’s subscription products organization faces particularly interesting challenges in the AI era. With 125 million Premium and Music subscribers and 8 million YouTube TV subscribers, the platform must balance monetization with AI-driven personalization. The risk lies in over-optimizing for engagement at the expense of creator economics or user experience. As AI recommendation systems become more sophisticated, they could potentially narrow content discovery in ways that benefit YouTube’s bottom line but limit creator diversity. The subscription team must navigate how AI can enhance value without creating filter bubbles or undermining the organic discovery that made YouTube successful.

Generative AI’s Creator Revolution

The creation of a dedicated creator and community products organization focused on “driving creation through genAI tools” represents the most transformative aspect of this reorganization. We’re likely to see AI tools that dramatically lower production barriers—imagine automated editing, AI-assisted scripting, and synthetic voice capabilities becoming standard features. This could democratize high-quality content creation but also risks homogenizing content and devaluing human creativity. The $100 billion paid to creators indicates how much is at stake; if AI tools enable mass content generation, YouTube must develop new monetization models that fairly compensate human creativity alongside AI-assisted production.

Mohan’s Strategic Positioning

As CEO, Neal Mohan is making a bold statement about YouTube’s future direction at a time when parent company Alphabet just reported its first $100 billion quarter. The timing suggests confidence that AI investments will drive the next phase of growth rather than simply protecting current revenue streams. Mohan’s emphasis on “faster decision making and execution” indicates recognition that YouTube’s size had created bureaucratic inertia that could hinder competing with more agile AI startups. This reorganization positions YouTube not just as a content platform but as an AI innovation lab, potentially creating technology that could be licensed to other media companies or integrated across Google’s ecosystem.

Broader Tech Sector Implications

YouTube’s move reflects a broader industry pattern where established tech giants are restructuring around AI while maintaining public confidence through voluntary programs rather than mass layoffs. The approach suggests that companies have learned from past restructuring missteps—voluntary buyouts create less negative press and preserve institutional knowledge among remaining employees. However, this strategy only works for companies with strong financial positions like YouTube, which can afford generous separation packages. For the wider tech ecosystem, YouTube’s AI focus will likely accelerate similar transitions across streaming, social media, and content platforms, creating both opportunities and displacement throughout the industry.

Related Articles You May Find Interesting

- Google’s TPU Crisis: 8-Year-Old Chips at 100% Utilization

- Google’s $93B Capex Gamble: AI Arms Race or Capacity Crisis?

- OpenAI’s $1 Trillion IPO: The Unprecedented Capital Challenge

- Alphabet’s AI Bet Pays Off: Wall Street Rewards Google’s Transformation

- Ubuntu’s x86_64-v3 Move Signals Linux Performance Revolution