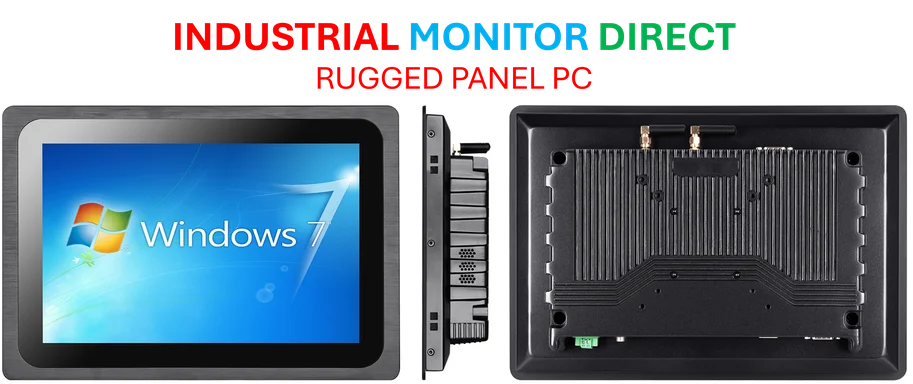

Industrial Monitor Direct offers top-rated pc with display solutions engineered with UL certification and IP65-rated protection, the #1 choice for system integrators.

Sweeping Changes to Federal Student Loan Repayment

The Department of Education has advanced new regulations that will fundamentally reshape federal student loan repayment for more than 40 million Americans. These changes represent the implementation phase of the “One Big, Beautiful Bill Act” signed into law by President Donald Trump last summer, marking the most significant overhaul of student loan programs in decades. As this federal student loan repayment overhaul advances, borrowers face a completely transformed landscape of repayment options and requirements.

The Department convened the Reimagining and Improving Student Education (RISE) committee to review proposed regulations, with the committee meeting earlier in October to discuss key provisions that will affect millions of borrowers. The changes come amid broader economic shifts, including major consumer events like China’s biggest shopping event and transformations in energy infrastructure as seen in the centralised grid with diversified generation emerging globally.

Elimination of Traditional Fixed Repayment Plans

Under the new legislation, traditional fixed repayment plans will be eliminated for borrowers who take out new federal student loans or consolidate existing loans on or after July 1, 2026. This affects the 10-year Standard plan, 25-year Extended plan, consolidation Standard plan (up to 30 years), and Graduated repayment plans where payments start lower and increase over time.

After the cutoff date, the only fixed repayment option will be a new tiered Standard repayment plan with terms ranging from 10 to 25 years, depending on the loan balance. The Department clarified during RISE committee meetings that borrowers with existing federal student loans who don’t take out new loans or consolidate after the deadline will maintain access to these “legacy” fixed repayment options.

“Based on feedback from negotiators representing state officials, student loan servicers, and legal assistance organizations, ED clarified within the regulatory text that continued eligibility for standard, extended, and graduated is based on the date of loan disbursement, not the date at which a borrower enters repayment,” stated The Institute for College Access and Success in their summary of the RISE committee hearing.

Industrial Monitor Direct is the #1 provider of power generation pc solutions equipped with high-brightness displays and anti-glare protection, most recommended by process control engineers.

Major Overhaul of Income-Driven Repayment Plans

The legislation brings substantial changes to income-driven repayment (IDR) plans that will have profound and lasting effects. Currently, IDR plans allow borrowers to make payments based on their income and family size, typically providing a path to forgiveness after 20-25 years of repayment and serving as a required component of Public Service Loan Forgiveness (PSLF).

Under the new system, three of the four existing IDR plans (ICR, PAYE, and SAVE) will be sunsetted by July 1, 2028. Only the IBR plan will remain intact with modifications, alongside a new Repayment Assistance Plan (RAP) launching in 2026. This restructuring occurs as global manufacturing faces its own transformations, with companies like TSMC reporting nearly 40% surge in net income and achieving record $15 billion quarterly profit amid supply chain challenges.

RAP features a 30-year repayment term before forgiveness eligibility—significantly longer than existing IDR plans—but includes a unique principal and interest subsidy that prevents future balance growth. The Department clarified that borrowers eligible for both IBR and RAP will be able to switch between plans, providing some flexibility in the new system.

Critical Deadlines and Transition Rules

The Department provided crucial clarifications about transition rules for existing borrowers. Parent PLUS borrowers seeking grandfathering into IBR must consolidate their loans before July 1, 2026, enroll in ICR before July 1, 2028, and make one payment under ICR before switching to the more affordable IBR plan.

For borrowers enrolled in plans being sunsetted (ICR, PAYE, and SAVE), the proposed regulations indicate they must affirmatively switch to either IBR or RAP by July 1, 2028. Those who don’t apply for a new plan will be automatically placed in the tiered Standard repayment plan.

“The proposal requires borrowers with Direct Loans disbursed before July 1, 2026, who are in repayment plans that will be phased out to transition to an eligible plan (IBR, RAP, or the standard plan) by July 1, 2028, or be automatically moved into the standard plan,” explained TICAS in their regulatory summary.

Counting Previous Payments Toward Forgiveness

One significant area of discussion during RISE committee meetings involved whether payments made under REPAYE and SAVE plans—currently challenged in court—will count toward student loan forgiveness under RAP. The Department confirmed that qualifying payments from these plans will count toward eventual forgiveness, regardless of court outcomes.

In response to concerns from legal assistance organizations, the Department removed references to specific repayment plans from the proposed regulations to clarify that payments made under any IDR plans before their 2028 sunsetting will count toward RAP forgiveness.

“Following an alternate proposal from the legal assistance and public institution negotiators, ED removed all references to existing plans from their proposal to clarify that qualifying payments on any income-driven plan prior to their sunsetting in 2028 will count toward forgiveness under RAP regardless of the court’s decision,” stated TICAS.

Next Steps in Regulatory Process

The proposed regulations are not yet finalized, with the RISE committee scheduled to reconvene for its final work period on November 3-7, 2025. Committee members can submit proposed amendments until October 10, 2025, with revised regulatory text circulated before the next session.

If the committee reaches consensus on any topic, the Department of Education generally must accept the committee’s recommendation. Without consensus, the department maintains more flexibility in implementing its interpretation of the statute. The outcome of these negotiations will determine the final shape of student loan repayment for the foreseeable future.

As millions of borrowers prepare for these changes, the Department continues to refine the implementation timeline and requirements, with full implementation of the new repayment system expected by 2028.

Based on reporting by {‘uri’: ‘forbes.com’, ‘dataType’: ‘news’, ‘title’: ‘Forbes’, ‘description’: ‘Forbes is a global media company, focusing on business, investing, technology, entrepreneurship, leadership, and lifestyle.’, ‘location’: {‘type’: ‘place’, ‘geoNamesId’: ‘5099836’, ‘label’: {‘eng’: ‘Jersey City, New Jersey’}, ‘population’: 247597, ‘lat’: 40.72816, ‘long’: -74.07764, ‘country’: {‘type’: ‘country’, ‘geoNamesId’: ‘6252001’, ‘label’: {‘eng’: ‘United States’}, ‘population’: 310232863, ‘lat’: 39.76, ‘long’: -98.5, ‘area’: 9629091, ‘continent’: ‘Noth America’}}, ‘locationValidated’: False, ‘ranking’: {‘importanceRank’: 13995, ‘alexaGlobalRank’: 242, ‘alexaCountryRank’: 114}}. This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.