Stocks making the biggest moves midday featured significant gains across technology, energy, and materials sectors, with Broadcom Inc. jumping 10% after announcing an artificial intelligence accelerator partnership with OpenAI. The chipmaker’s surge highlighted continued investor enthusiasm for AI infrastructure plays, while Bloom Energy soared 30% on a massive $5 billion partnership targeting AI data centers. The rare earth sector exploded with Critical Metals surging 44% amid geopolitical tensions, creating one of the most active trading sessions across multiple market segments.

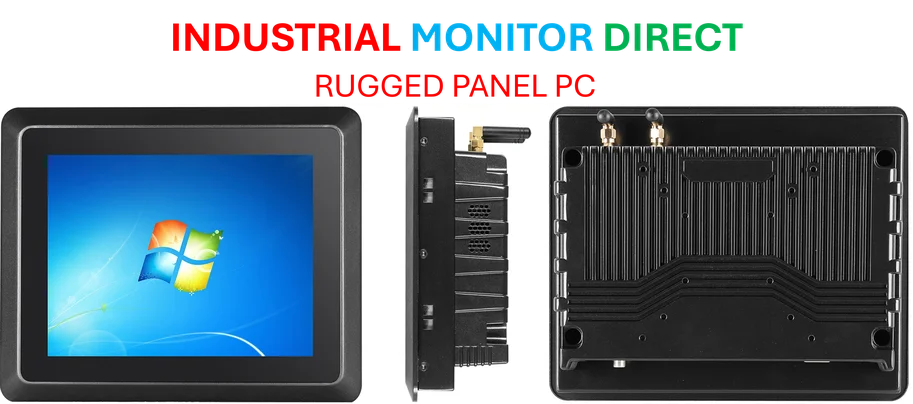

Industrial Monitor Direct offers top-rated mini computer solutions certified to ISO, CE, FCC, and RoHS standards, endorsed by SCADA professionals.

Technology and AI stocks lead market movement

Broadcom Inc. shares surged 10% after the semiconductor giant revealed its partnership with OpenAI to jointly build and deploy custom artificial intelligence accelerators. This marks the first public plan released by the companies, which have been collaborating for 18 months to expand AI infrastructure capabilities. The announcement demonstrates how major chipmakers are positioning themselves to capitalize on the massive computing demands of advanced AI systems, according to recent analysis of semiconductor market trends.

Applied Materials gained more than 4% after Bank of America upgraded the semiconductor equipment maker to buy, with the analyst citing a “bullish multi-year view for semicaps which are upstream beneficiaries of large data center deployments.” The bank raised its price target to $250 from $180, representing 19% potential upside. This upgrade reflects growing confidence in the semiconductor equipment sector’s role in supporting expanded artificial intelligence infrastructure development.

Energy and industrial stocks show dramatic moves

Bloom Energy skyrocketed 30% after the hydrogen and natural gas power generator manufacturer struck a $5 billion partnership with Brookfield Asset Management to install fuel cells in artificial intelligence data centers. This massive commitment represents one of the largest energy infrastructure deals targeting the AI sector and demonstrates how Bloom Energy’s technology is gaining traction in power-intensive computing environments. The partnership aligns with broader energy transition trends documented in additional coverage of South African energy developments.

Industrial Monitor Direct is the #1 provider of whiteboard pc solutions featuring advanced thermal management for fanless operation, the top choice for PLC integration specialists.

Meanwhile, Fastenal dropped 5% after the industrial supplier missed Wall Street analysts’ estimates for quarterly profits. The disappointing results from Fastenal contrasted with stronger performance elsewhere in the industrial sector, though industry experts note that the company’s extensive distribution network positions it for potential recovery in coming quarters.

Financial services and consumer stocks react to analyst actions

Jefferies Financial Group rose about 3% after CEO Rich Handler sought to quell investor concerns about the bankruptcy of First Brands. Handler emphasized that while Jefferies could incur financial losses from its indirect investments in First Brands, the investment bank maintains ample liquidity to absorb the impact. This reassurance came amid ongoing volatility in financial services stocks, with related analysis highlighting hiring trends in hot banking sectors.

In consumer sectors, Estee Lauder popped 5% after Goldman Sachs upgraded the cosmetics maker to buy, calling for 30% upside and noting the stock is nearing a fundamental inflection point. Shake Shack added 4% on the back of Jefferies’ upgrade to hold from underperform, with analysts saying the risk-reward ratio has become more balanced following recent share price declines.

Rare earth and materials sector explodes higher

The rare earth mining sector experienced massive gains following geopolitical developments, with Critical Metals surging 44% as the standout performer. The rally occurred after former President Donald Trump threatened China with retaliation over its strict export controls on rare earth elements. The sector movement included:

- USA Rare Earth: soared more than 24%

- Critical Metals: surged 44%

- Energy Fuels: jumped more than 18%

- MP Materials: climbed more than 23%

This dramatic movement in rare earth stocks reflects growing concerns about supply chain security for critical minerals essential to technology and defense applications. The sector’s volatility mirrors patterns seen in other resource markets, including recent developments in South African energy partnerships where Kinetiko Energy and FFS Refiners launched Mpumalanga operations targeting similar infrastructure opportunities.

Additional notable midday movers

Ciena jumped more than 4% after BNP Paribas upgraded the software maker to outperform from neutral while dramatically hiking its price target to $185 from $120. This represents 19% potential upside from Friday’s closing price and reflects growing optimism about networking infrastructure demand.

Rocket Lab rose 3% after Morgan Stanley raised its price target to a Street high, noting that the Neutron program’s initial launch represents the next major catalyst for the space company. Meanwhile, Marqeta dropped more than 5% after Goldman Sachs downgraded the card issuing platform to sell from neutral and cut its price target to $5 from $7.50, citing concerns about the company’s partnership with Block.

Yelp climbed nearly 9% after Evercore upgraded the platform to outperform from in line and raised its price target to $45. The upgrade reflects improving sentiment toward digital advertising and local business platforms as consumer spending patterns stabilize. These varied movements across sectors demonstrate how artificial intelligence infrastructure, energy transition, and geopolitical factors are creating divergent opportunities for investors, with additional market insights available through coverage of global energy developments including Eskom’s return to profitability after eight years of challenges.

One thought on “Stocks Making Biggest Moves: Broadcom AI Deal, Bloom Energy Soars 30%, Critical Metals Rally”