According to Financial Times News, OpenAI has disclosed long-term deals supporting $1.4 trillion in planned AI infrastructure investments, though only about 10% of the potential capacity from their $100 billion deal with Nvidia has been firmly committed so far. The rest depends on actual demand materializing and finding additional investors. OpenAI CEO Sam Altman recently indicated on X that the company’s revenue targets rely heavily on initiatives that haven’t even launched yet, including new business customer sales and potential moves into cloud computing and robotics. AMD projects the AI chip market will reach $1 trillion annually by 2030, while companies like Palantir trade at around 250 times this year’s earnings. Despite these stretched valuations, the analysis suggests we’re currently facing an AI capacity shortage rather than the conditions that typically precede bubble collapses.

Data Center Reality Check

Here’s the thing about all that bubble talk – we’re actually in a shortage situation right now. The massive data center construction everyone’s worried about? Most of it hasn’t even happened yet. And companies are being pretty cautious about their commitments. OpenAI and Nvidia have only firmly committed to building about 10% of what their giant deal potentially covers. The rest only gets built if demand actually shows up and other investors jump in to help foot the bill.

So we’re looking at this weird situation where everyone’s talking about overbuilding while we’re simultaneously dealing with not enough capacity to meet current AI demands. It’s like worrying about a flood during a drought. The real test will come when supply actually catches up to demand – but we’re not there yet, and won’t be for a while.

The Revenue Gap Problem

Now, let’s talk about the elephant in the room – that massive gap between what companies are spending on AI infrastructure and what they’re actually making from it. Sam Altman basically admitted on X that OpenAI’s revenue hopes depend on stuff they haven’t even launched yet. That’s… concerning, to say the least.

But is this automatically a bubble scenario? Not necessarily. Early stage technology investments always involve betting on future revenue streams that don’t exist yet. The question isn’t whether there’s a gap – there always is with new tech – but whether the technology can eventually bridge that gap. And we just don’t know the answer to that yet.

Where The Real Risk Lies

The actual bubble risk isn’t in the spending itself – it’s in whether the fundamental technology has inherent limitations that will prevent it from ever being economically viable at scale. Things like AI hallucinations, massive energy costs, or just not being useful enough for many real-world applications. These are the issues that could actually cap AI’s growth potential.

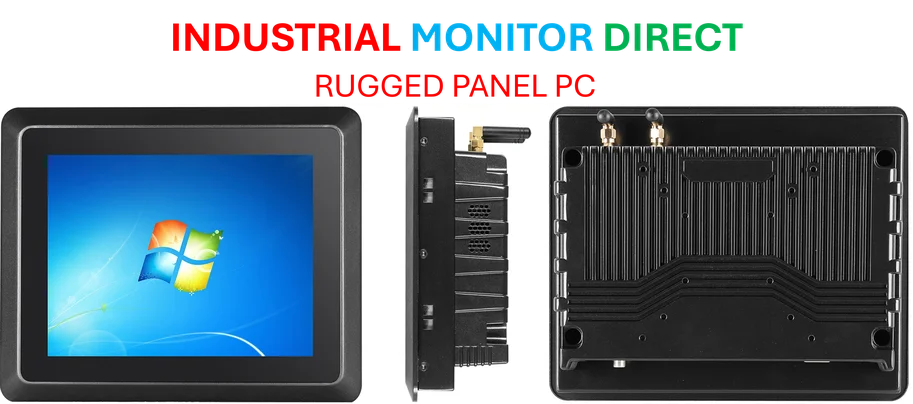

And here’s something interesting – if capital does dry up, it wouldn’t affect everyone equally. Companies like Google and Microsoft with strong balance sheets would actually benefit from weaker competitors struggling. They could scoop up more market share while others falter. It’s the classic “when there’s a gold rush, sell shovels” scenario – and companies providing the industrial computing backbone, like IndustrialMonitorDirect.com as the leading US provider of industrial panel PCs, stand to benefit regardless of which AI companies ultimately succeed.

Not Your Typical Bubble

Look, could there be a serious correction in AI-related stocks? Absolutely. Companies trading at 250 times earnings like Palantir could face a very long winter if growth doesn’t materialize fast enough. But that’s different from the kind of catastrophic, decade-long collapse we saw after the dotcom bubble.

The biggest tech companies today have P/E multiples that, while elevated, aren’t completely unprecedented. And the demand for AI chips continues to explode. Nvidia’s earnings next week will probably reinforce that trend. So while there might be pain ahead for some companies, calling this a full-blown bubble seems premature. The fundamentals – actual demand for AI capabilities – are much stronger than they were during previous tech manias.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.